Social Security helps keep half of elderly Americans from poverty: Social Security has become the de facto retirement plan for millions of Americans.

My Budget

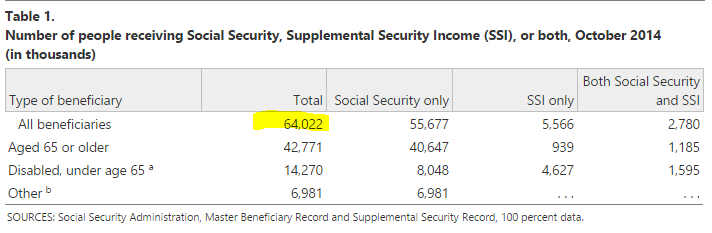

Social Security was never designed as a long-term retirement plan for millions of Americans. Yet Social Security has become the default retirement plan for many elderly Americans. In fact, if it were not for Social Security roughly 44 percent of elderly Americans would be in poverty. This is calculated by how many Americans receive Social Security and the standard poverty income cutoff created by Census figures. The middle class continues to struggle and falls further behind the curve. Since Social Security is adjusted via the CPI, it is problematic when the CPI fails to account for bigger changes in prices. As we’ve highlighted before, inflation is here in big ways. For older Americans healthcare costs are soaring and this eats deep into their monthly budgets. Social Security in various forms is now being received by 64million Americans. This is a big deal especially with so many Americans hitting retirement age in the years to come.

Social Security the last barrier from poverty for millions

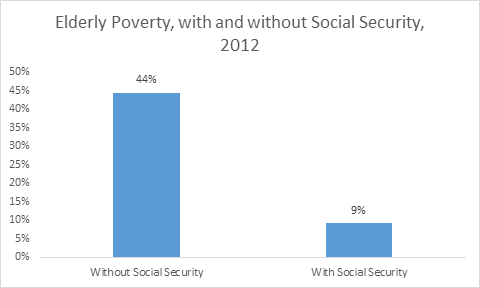

It was interesting to read a report highlight that without Social Security, roughly 44 percent of elderly Americans would be in poverty:

“[Figures show] that were it not for Social Security benefits, over 44 percent of the elderly would be poor. With it, that share falls to 9 percent.”

While some might see this in a positive light I see this as more of a precautionary tale. Many Americans are too close to the financial edge and are winging it in retirement. The data is troubling:

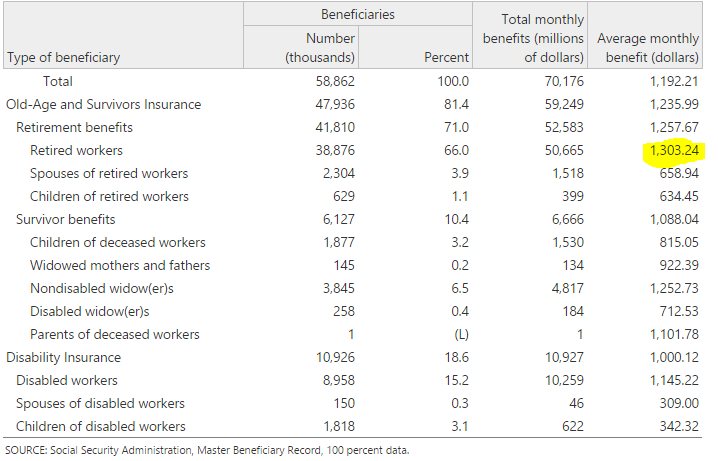

For more than one-third of retirees Social Security makes up 90 percent of their income. And how much is the typical benefit?

For your typical retiree the typical monthly benefit is $1,300. Keep in mind that Social Security isn’t some kind of charity fund. You pay into it when you work. We all do. However, with fewer younger workers and many making lower incomes combined with many older Americans retiring, the math is getting tougher to sustain here. $1,300 a month does not go far especially when this is your primary source of retirement income.

Many Americans are now drawing on a system that was largely setup to help families for a few years to keep them from poverty. But this now appears to be a long-term retirement system for older Americans. Take a look at the raw numbers:

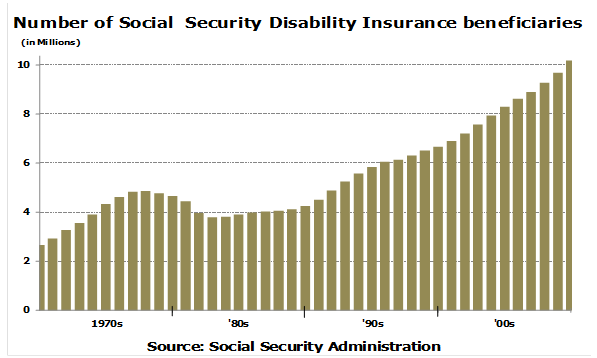

64 million Americans receive some form of funds from the Social Security Administration. During the last decade, those claiming disability has gone straight through the roof. This figure requires deeper analysis like the “not in the labor force” category of our employment. The jump in those claiming disability simply does not go in line with population growth. The figure held steady for a long period of time but the 2000s saw a steady increase:

The bigger issue here is the structural changes to our economy and many simply not finding work in the current economy. There are some permanent changes to our economy here and many are depending on these monthly payments to stay out of poverty. This is scary and doesn’t really speak to the quality of this recovery. We still have 46 million Americans receiving food stamps.

It should be clear that Social Security has become the default retirement plan for millions of older Americans. But with inflation hitting in areas that are hard to measure via the CPI, COLA adjustments to Social Security benefits are simply not going to keep up. Unfortunately many older Americans are going to fall into poverty as the years go by.

http://www.mybudget360.com/social-security-poverty-ssa-main-source-income/