The Most Exciting Oil Plays Of 2020

Joao Peixe for Oilprice

"On a long enough timeline, the survival rate for everyone [and everything] drops to zero."

For better or for worse, that grim and almost cynical quote by the charismatic anarchist Tyler Durden of Fight Club is set to one day become an existential crisis for the non-renewable energy sector.

The jury is still out regarding how close we are to hitting Peak Oil or even whether abiotic oil is a real thing.

Granted, the sun and other renewable sources will someday share the same fate as their more ephemeral cousins and succumb to the second law of thermodynamics--only that we are talking about some seriously dizzying timelines measured in the billions, not tens or hundreds of years--hence the distinction.

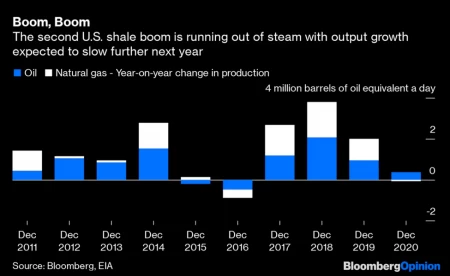

For the US shale industry, the future hangs in the balance. It's now official: after a phenomenal decade-long run that has propelled the United States to the top of the oil producers' league, America's second shale boom is running out of gas.

According to the US Energy Information Administration, drilling in the Permian--easily the most prolific of the shale basins--declined 11% in the nine months to August. Output growth over the next year is expected to clock in at just 370,000 barrels a day--the slowest clip in four years. With oil prices remaining stubbornly low and no respite in sight, drillers in the shale patch are struggling and rig count has seen a steady decline.

The only thing supporting growth is a 'fracklog' of drilled but uncompleted (DUC) wells that are now coming online as shale producers like Apache Corp. focus more on well completion and less drilling under squeezed budgets.

The situation could get a lot more dire for the industry if Democratic presidential front-runners senators Bernie Sanders and Elizabeth Warren have their way and ban fracking after ascending to the Oval Office.

That's decidedly gloomy.

But what's the outlook for other parts of the globe?

IMG URL: https://d32r1sh890xpii.cloudfront.net/tinymce/2020-02/1580829631-o_1e08cgprtd5d1chcvkd1nd1d1d8.webp

Texas-based Permian and Eagle Ford might boast the most street cred of any shale plays, anywhere on the planet.

However, there are other regions that are pretty well endowed. Not only are they ready and willing to seize the moment, but they're positioned to be the next major shale boom venues.

#1 Argentina's Vaca Muerta

Vaca Muerta might mean 'dead cow' in Spanish; however, Argentina's prized gem might soon become one of its leading cash cows instead.

Located on an arid steppe nestled against the Andes mountains along the western edge of Patagonia, Vaca Muerta is a continuous tight oil and shale gas reservoir that's reputed to be one of the largest of its kind. The 30,000 square kilometers (12,000 sq mi.) patch of land consisting of lime mudstones, black shale and marl and is estimated to hold approximately 16.2 billion barrels of oil and 308 trillion cubic feet of natural gas as per the EIA. The shale is found at a depth of about 9,500 feet (2,900 m).

In comparison, the Permian Shale contains 20 billion barrels of oil and 16 Tcf of associated natural gas.

Unfortunately, Vaca Muerta has little to show for its vast riches with proper production yet to commence a century since oil was first discovered there by American geologist Charles E. Weaver--thanks to the region's checkered history.

Over the past eight years, Chevron and YPF SA, the local oil giant, Royal Dutch Shell and Total have sunk between them $13 billion into exploration into this unconventional play. No company though had much to show for its efforts with obstacles popping up everywhere and production marginal.

That's until this year when two companies managed to export light oil and liquefied natural gas in what the country's officials said foreshadows a steady flow of shipments by year-end. Unfortunately, that too looks unlikely after the Argentina Energy Secretariat once again extended the deadline for bidding for a project to build a 1,000 km pipeline to carry gas from the giant formation.

With the Argentinian economy so weak, it could be years or maybe even decades before Vaca Muerta can rival US Permian Shale but make no mistake about it, the country appears dead-set at making this a reality. And Chevron, Shell and Total are likely to see their massive investments begin to pay off when it the region begins to turn around.

#2 Kavango Basin, Namibia

And if Karoo is a shale windfall, Kavango is its likely extension, according to geologists.

The Kavango Basin has the same Karoo geology, and it's also been shown to have the same depositional environment as Shell's Whitehill Permian shale play, part of the Karoo Supergroup in South Africa.

The 6.3-million-acre (25,000 square kilometers) Kavango Basin is similar in size to the Eagle Ford basin.

And right now, a 90% interest in the exploration license for the entire basin is owned by one small-cap explorer: Recon Energy Africa (TSX.V: RECO, OTCMKTS:LGDOF), with a market cap of only $40 million and shares selling for under $0.80.

It's pretty unique for a company this small to have a basin this big, but while few have heard of the company, everyone in the business has heard of the geophysicist who examined the data on this basin. They've also heard of Recon's CEO, Jay Park QC—the former director of Caracal Energy, which was acquired by giant Glencore in 2014 for $1.3 billion.

Bill Cathey is the geophysicist to some majors. When Recon brought the magnetic survey data from Namibia's Kavango Basin to Cathey, Cathey said the data showed a 30,000-foot sedimentary basin. He also said that a basin this deep, everywhere else in the world, produces commercial hydrocarbons. Management of Recon dropped everything, so the story goes, got on a plane, and finalized the deal for an exploration permit for the petroleum and natural gas rights to the giant Kavango Basin.

So, now, tiny Recon (TSX.V: RECO, OTCMKTS:LGDOF) is sitting on a basin that's the same size as the Eagle Ford.

Recon has a 4-year exploration license leading to a 25-year production license starting when it has made a commercial discovery.

Sproule--a tier 1 resource assessment company--estimated that Kavango has a potential 12 billion barrels of oil or 119 trillion cubic feet of natural gas. That's for the shale and doesn't count any conventional potential.

The first test wells are slated to be drilled in Q2 2020.

That's just a few months away.

Namibia is one of the most oil-friendly up-and-coming oil venues in the frontier of Africa. Ask Shell, or Exxon, both of whom are acquiring assets there.

Shell (NYSE:RDS.A), for its part, is a veteran in the African oil and gas game. The company began drilling in the region in the 1950s, and now has assets in over 20 countries across the continent. Though it has sold off a number of assets in the region in recent years due to unfavorable regimes, it continues to maintain a strong presence in South Africa and Namibia.

Exxon (NYSE:XOM), on the other hand, is relatively new, but quickly upping its stake. The company has already added over 7 million acres in four additional deepwater blocks just this year. What Exxon's banking on is that Namibia, which according to theory once fit together with Brazil, shares the same geology as Brazil's pre-salt basins, Santos and Campos, which have already proved resource-rich, according to Deloitte.

Whether it's Namibia, Argentina or South Africa, what we do know is that the U.S. has already had its shale boom, and the next multi-million-dollar oil play is probably going to come from somewhere else.

#3 Karoo, South Africa

The Karoo is a vast sedimentary basin covering more than 600,000 square kilometers in central and southern South Africa.

Although the sheep- and ostrich-dotted expanse is better known for its arid beauty and aching poverty, it could hold untold riches underneath the surface in the form of natural gas. Former South African governments placed restrictions that made Karoo out of reach for foreign companies. However, President Zuma's government lifted the shale fracking ban in 2012 thus opening up 485 Tcf of gas reserves for drilling.

If the EIA estimates are accurate, the Karoo shale gas fields would qualify as the fifth largest in the world. The gas extracted could power the entire country for a good 400 years and create thousands of much-needed jobs.

The South African Journal of Science has, however, disputed the EIA reserve estimates saying that actual shale gas deposits are only 13 Tcf thus ranking the country 34th out of 46 nations in EIA estimates.

Although local farmers and environmentalists are opposed to any fracking activity in Karoo, three foreign companies-Falcon Oil, Royal Dutch Shell and Sunset Energy–have already been granted licenses to explore for gas in the basin.

Bonus: Big Oil Diving Into Uncharted Waters

Though there are a number of exciting hotspots popping up across the globe, it's also important to pay attention to oil companies taking big risks on little-known exploratory projects.

Take Total (TOT), for example. It recently announced a major oil discovery offshore Suriname with its partner, Apache (APA). Apache's agreement with Total included $100 million upfront payment and expenses incurred in exploration. The find was a major boon for both Total and Apache, especially considering there had not previously made any commercially viable oil discoveries. The find is doubly beneficial for Suriname, which could be a significant turning point for the small country's economy.

Though it's not entirely off the beaten path, Egypt has also captured the attention of Big Oil in recent years. Just last month, in fact, the country awarded Chevron (NYSE:CVX) and Shell key exploration blocks in the red-hot Red Sea. The blocks cover a total area of around 10,000 sq km and carry combined minimum investment of $326 million, Egypt's petroleum ministry said, adding that potential investment would rise to "several billion dollars" if discoveries were made.

By. Joao Piexe

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements. Statements contained in this document that are not historical facts are forward-looking statements that involve various risks and uncertainty affecting the business of Recon. All estimates and statements with respect to Recon's operations, its plans and projections, oil prices, recoverable oil, production targets, production and other operating costs and likelihood of oil recoverability are forward-looking statements under applicable securities laws and necessarily involve risks and uncertainties including, without limitation: risks associated with oil and gas exploration, development, exploitation and production, geological risks, marketing and transportation, availability of adequate funding, volatility of commodity prices, imprecision of reserve and resource estimates, environmental risks, competition from other producers, government regulation, dates of commencement of production and changes in the regulatory and taxation environment. Actual results may vary materially from the information provided in this document, and there is no representation that the actual results realized in the future will be the same in whole or in part as those presented herein. Other factors that could cause actual results to differ from those contained in the forward-looking statements are also set forth in filings that Recon and its technical analysts have made, We undertake no obligation, except as otherwise required by law, to update these forward-looking statements except as required by law.

Exploration for hydrocarbons is a speculative venture necessarily involving substantial risk. Recon's future success will depend on its ability to develop its current properties and on its ability to discover resources that are capable of commercial production. However, there is no assurance that Recon's future exploration and development efforts will result in the discovery or development of commercial accumulations of oil and natural gas. In addition, even if hydrocarbons are discovered, the costs of extracting and delivering the hydrocarbons to market and variations in the market price may render uneconomic any discovered deposit. Geological conditions are variable and unpredictable. Even if production is commenced from a well, the quantity of hydrocarbons produced inevitably will decline over time, and production may be adversely affected or may have to be terminated altogether if Recon encounters unforeseen geological conditions. Adverse climatic conditions at such properties may also hinder Recon's ability to carry on exploration or production activities continuously throughout any given year.

DISCLAIMERS

ADVERTISEMENT. This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) may in the future be paid by Recon to disseminate future communications if this communication proves effective. In this case the Company has not been paid for this article. But the potential for future compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated but may in the future be compensated to conduct investor awareness advertising and marketing for TSXV:RECO. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company's stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendations. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits similar to those discussed.

Link to original article: https://oilprice.com/Energy/Energy-General/The-Most-Exciting-Oil-Plays-Of-2020.html

By Joao Peixe