Six Of The Hottest Oil Stocks For 2020

Charles Kennedy for Oilprice

This is what the bears don't get about oil stocks: These are no longer the reckless, wasteful, binge years of the shale boom. The smart companies have adapted to a new reality.

Now, it's about dramatic new offshore discoveries that are being brought online in record speed.

It's about brilliant new well-completion designs that enhance productivity.

It's about integrated giants who win, either way.

It's about extremely ambitious small-caps that slip into new venues and scoop up massive basins when no one's looking.

It's about ingenuity on multiple levels that translates into something for every investor appetite.

Here are 6 stocks to watch in 2020, and between them they cover every sort of risk-vs-reward level out there:

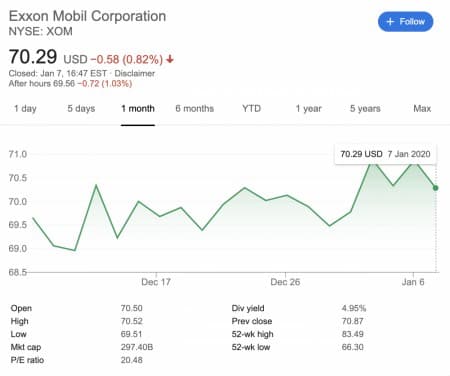

#1 ExxonMobil (NYSE:XOM): The Best Recovery

IMG URL: https://d32r1sh890xpii.cloudfront.net/tinymce/2020-01/1578435317-o_1du1171v91vnl11e2fsvdp33798.jpg

If dividends are what you're after, look no further on the oilfield. Even the volatility of the oil and gas market over the past years have failed to disrupt Exxon's dividend payouts.

First, the supergiant's Q3 earnings report last week was better than expected, with earnings of 75 cents per share--compared to analyst estimates of 67 cents. Sales, at $65.05 billion, also beat estimates. And it's planning to double its cash flow through 2025.

One of the most exciting things is the new oil that will come online from the superstar Guyana-Suriname Basin and Exxon's 14 finds that just put Guyana on the oil map.

It's also got new production and infrastructure coming online in the Permian basin, not to mention a major LNG project in Mozambique.

Our assessment is that Exxon is recovering nicely, and 2020 should see much better performance, particularly following the divestment of its North Sea assets for a cool $3.5 billion.

But overall, the great thing about Exxon is that no matter how oil prices fluctuate, this integrated giant is covered. Lower oil prices help its upstream assets, while higher prices boost the downstream.

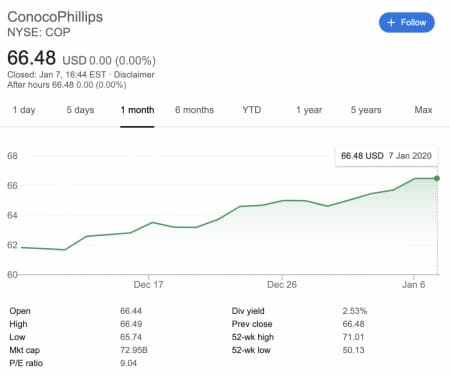

#2 ConocoPhillips (NYSE:COP): Deliverance

IMG URL: https://d32r1sh890xpii.cloudfront.net/tinymce/2020-01/1578435348-o_1du117vfk1jc745v1o51n8ms308.jpg

Few oil stocks shared in as much glory as COP when it comes to Q3 earnings. Not only did COP report a net income increase to $2.74 share, or $3.056 billion, but it also managed adjusted earnings of $914 million, or $0.82 per share.

Earlier in October, it also announced a 38% increase in its quarterly dividend, along with plans to repurchase $3 billion of shares next year.

COP has had lots of ups and downs this year, but this is what we like: It's refocusing more narrowly on US shale, and on the Permian in particular. It's spent the last year cutting costs and getting slimmer and trimmer, including a deal to sell its Australian assets for $1.4 billion. It's likely that US shale expansion plans are in the works here, so this is a bet on that.

#3 Recon Africa (TSX.V:RECO): Small Cap Sitting on Eagle Ford-Size Basin

Recon Africa has just received an exploration license for a huge area for a tiny company with a market cap of only around $28 million and shares selling for under $0.50. Yet, it's got 90% of the exploration rights to a shale basin of 25,000 square kilometers, that's the same size as the Eagle Ford. It acquired the oil and gas rights for the entire 6.3-million-acre Kavango Basin in Namibia— with Africa's oil production friendly government.

It's pretty unique for a company this small to have a basin this big, so when it happens, we take note. We've also taken note of the CEO, Jay Park QC, who is the former director of Caracal Energy, which was acquired by giant Glencore in 2014 for $1.3 billion. That puts RECO squarely on our radar. So does anything that goes through Bill Cathey, well known geoscientist. We've heard that Cathey examined the Kavango Basin magnetic data and said it's comprised of a 30,000-foot sedimentary basin. That's when RECO licensed rights to the rest of the massive basin.

IMG URL: https://d32r1sh890xpii.cloudfront.net/tinymce/2020-01/1578435385-o_1du118h9s2u1mi41nh6nkiomb8.jpg

They have a 90% interest in a 4-year exploration license leading to a 25-year production license on commercial discovery, and the first test wells are slated to be drilled in Q2 2020--just a few months away.

The Kavango Basin is part of the Karoo Supergroup of geology, and it's also been shown to have the same depositional environment as Shell's Whitehill Permian shale play, part of the Karoo Supergroup in South Africa.

Sproule - a tier 1 resource assessment company - estimated that Kavango has a potential 12 billion barrels of oil or 119 trillion cubic feet of natural gas. That's just for the shale. It doesn't include any conventional potential.

Namibia is one of the up-and-coming oil venues in the frontier of Africa. Ask Shell or Exxon, both of whom are acquiring a lot of assets here, making Recon a natural acquisition target if a commercial discovery is made.

#4 HESS (NYSE:HES): Key Partner to the Giants

IMG URL: https://d32r1sh890xpii.cloudfront.net/tinymce/2020-01/1578435409-o_1du119pr2rg1u0o1s927v797v8.jpg

Not only is HESS sharing in the future wealth of the outsized oil discoveries with Exxon in Guyana at the Stabroek Block, but it will also be getting a boost from the block's ahead-of-schedule first production in December.

Right now, HESS is doing well enough as it is on its position in US shale, in the Bakken, and when it adds its Guyana production to its portfolio by the end of this year, that will outshine the Bakken. So, what's good becomes even better.

This stock is looking great going into 2020, and it exceeded its Q3 output guidance based on the Bakken alone. In fact, Hess' Bakken production got a 38% boost year-on-year--way past expectations--and thanks in part to a new well-completion design to enhance productivity. That's really what we like to see.

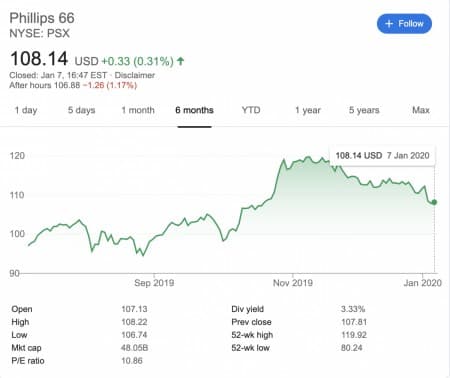

#5 Phillips 66 (NYSE:PSX): The Other Way to Cash in on the Permian

IMG URL: https://d32r1sh890xpii.cloudfront.net/tinymce/2020-01/1578435444-o_1du11atf519ufs5g13t0184f1ko78.jpg

PSX soared more than 15% in October. It's loving the low oil prices for its refineries, and now it's busy building up pipelines, too, to carry all that Permian largesse to the refiners.

It's targeted over $4 billion in pipelines. The next big pipeline in the … pipeline is one that leads from the Permian Basin to the Gulf Coast--meeting a major demand and allowing Phillips 66 to rake in more cash on more cheap North American oil.

This company is a bet on low oil prices--bottom line.

Fairly confident in the knowledge that nothing short of WWIII will result in a surge in oil prices at this point, this is Phillips 66's playground through the rest of this year and presumably into 2020.

That's refining + roaring midstream businesses that are doing much more than thriving in this atmosphere.

#6 Halliburton (NYSE:HAL): The Innovative Oilfield Service Giant

IMG URL: https://d32r1sh890xpii.cloudfront.net/tinymce/2020-01/1578435476-o_1du11brmlo2t13ka3v7oqcd9h8.jpg

Halliburton is one of the largest oilfield services companies in the world. The company has secured its place as a giant in the oil and gas industry. But it didn't happen overnight.

Over the past month, Halliburton has jumped by 12% on a string of positive news.

The oilfield services sector is highly competitive and ripe with innovation. In order to stay ahead, companies must be on the absolute cutting edge of technology. And that's exactly what Halliburton has done.

And recently, Halliburton increased the heat for its competition. Partnering with Microsoft, Halliburton has become one of the most exciting "tech" plays in the industry.

This partnership is significant. Microsoft, a leader in the tech world, is looking to bring machine learning, augmented reality, and the Industrial Internet of Things to the oil and gas industry, and Halliburton is welcoming the new take on the resource realm with open arms.

In addition to its forward looking approach with regards to technology, Halliburton is also wheeling and dealing in the traditional oil world.

In its efforts to expand outside of the U.S. shale boom, the oilfield services behemoth has secured major deals in the Middle East, including a $597 million contract with Kuwait Oil Company to help develop its offshore program.

Link to original article: https://oilprice.com/Energy/Energy-General/Six-Of-The-Hottest-Oil-Stocks-For-2020.html

By Charles Kennedy for Oilprice.com