"All Hell Could Break Loose": Wednesday's "Liquidation Combination Of Doom" Has Taken Place On Only Two Prior Occasions In History

Tyler Durdan

Yes, yesterday's furious 3.5% equity selloff - the biggest since June 11 - was painful, but in isolation it should have been manageable for investors using legacy balanced 60/40 (or risk parity) portfolios. However that was not the case because as BofA's Hans Mikkelsen writes overnight, what was truly unique about the Wednesday rout is that as stocks cratered, Treasury yields rose and gold dropped, or as he puts it "everything was on sale", in other words, it was a perfect liquidation.

Such a selloff is so against the core tenets of conventional market flows, that this combination - of stocks, bonds and gold down on the same day - only happened twice in market history – on March 11 and March 18th - during the liquidity crisis where nearly all assets where liquidated as risk-parity funds were hammered.

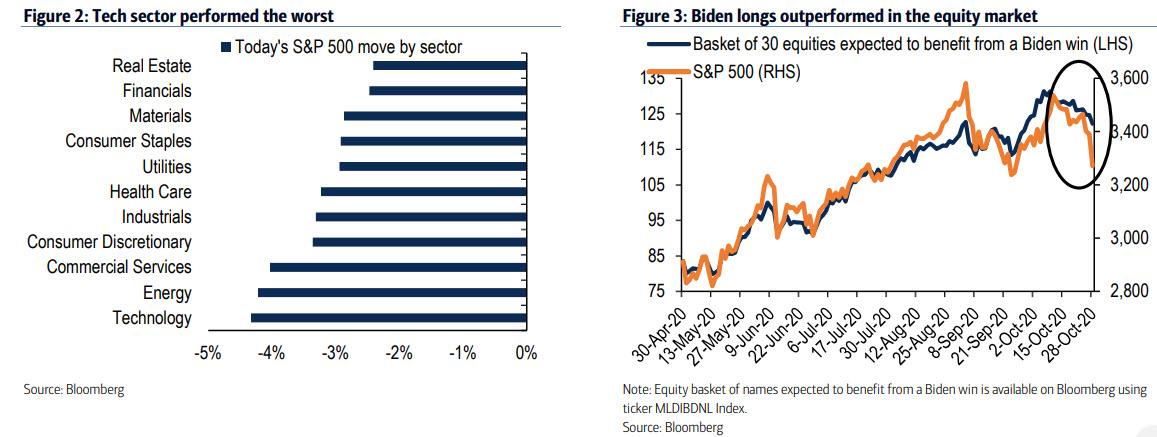

As BofA notes, while Wednesday moves were to some extent in reaction to a deteriorating Covid-19 situation globally and lockdown-type measures being re-imposed in Europe "that can’t be the only story as the Technology sector, which benefits from stay-at-home, performed the worst." It also can’t be that polls suggesting improving odds for President Trump for next week’s election got investors worried about less fiscal support as Biden longs outperformed in the equity market.

So according to BofA what happened on Wednesday was that investors already positioned for either outcomes for the various near term risks decided to "dial it down a touch in order to reduce risk" and deleverage, a move that hit "balanced portfolio" investors the hardest.

And in the latest ominous development for risk-parity funds, BofA warned that "at these low yields the Treasury market does not offer attractive hedging properties for a risk-off environment" especially since increased Corona risk would lead to more fiscal stimulus and higher supply of Treasuries.

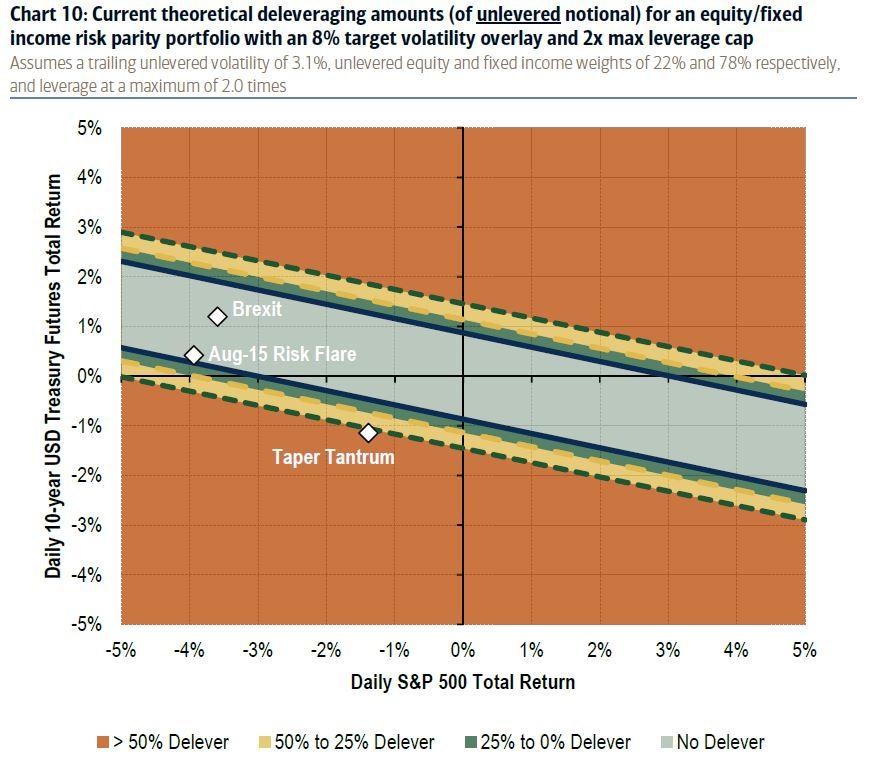

Which brings us to the risk-parity "matrix of doom", which we have discussed previously and which shows at what drops in both bonds and stocks risk parity portfolios are forced to delever aggressively.

As the chart shows, another -3.5% day coupled with a modestly bigger jump in yields, and coupled with further selling in gold which is increasingly used as the "40" in 60/40 portfolios, and all hell can break loos