The US recovery story is a fraud? The reality is that the vast bulk of economic, as well as earnings, data has been simply dreadful….

IWB [Investment Watch Blog]

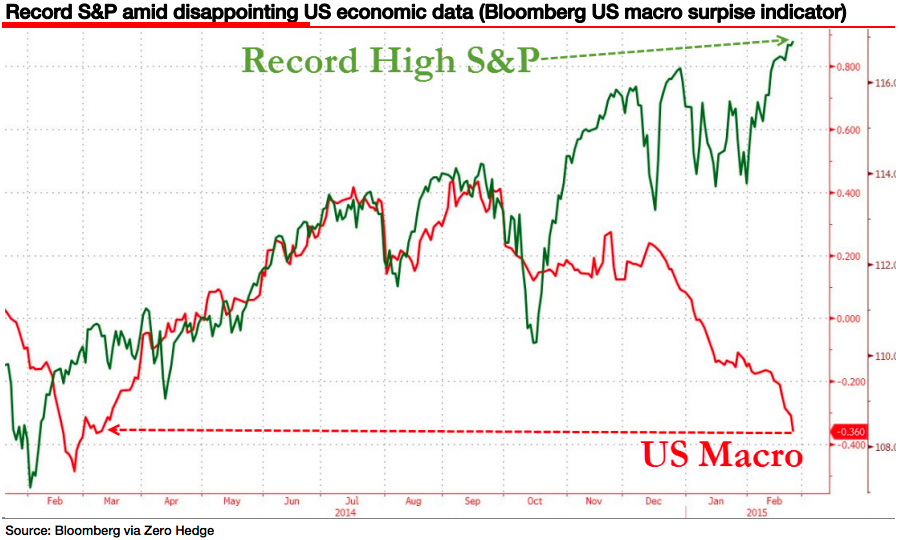

Most US economic data missed expectations in February.

And that investors are sending stocks to all-time highs is making Societe Generale’s Albert Edwards crazy.

In a note Thursday, Edwards wrote:

“With equity markets galore hitting record highs clearly I must be missing something big! We are at that stage in the cycle where I begin to doubt my own sanity. I’ve been here before though and know full well how this story ends and it doesn’t involve me being detained in a mental health establishment (usually).”

From Janet Yellen’s testimony on Capitol Hill earlier this week, Edwards points out that the Federal Reserve is being patient and data-dependent so that it doesn’t “risk the economic recovery.”

“Investors are transfixed instead by the Fed and when it will tighten rates and can’t see the wood for the trees. The Fed’s focus on payrolls, a lagging indicator, is most perplexing but not unusual at this stage in the cycle. The reality is that the vast bulk of economic, as well as earnings, data (even outside the energy sector), has been simply dreadful.”

Here’s a chart he included that illustrates the disconnect between the economic data and the stock market.

image: http://static5.businessinsider.com/image/54ef2800eab8ea362186bcc7-899-540/screen%20shot%202015-02-26%20at%208.29.24%20am.png

Societe Generale

Societe Generale

Read more: http://www.businessinsider.com/albert-edwards-is-doubting-his-own-sanity-2015-2#ixzz3StDGY0UV

The US recovery story is a fraud: SocGen bear

Societe Generale’s notoriously bearish strategist, Albert Edwards, has poured scorn on the belief that the U.S. economy is recovering and predicts “violent” reactions in asset markets during the second half of 2015.

“The downturn in U.S. profits is accelerating and it is not just an energy or U.S. dollar phenomenon – a broad swathe of U.S. economic data has disappointed in February,” he said in a research note published Thursday.

U.S. indexes have continued to hit all-time highs this year and theNasdaq is also looking to break through a level last seen at the peak of the tech bubble in 2000.

However, Edwards said that, rather than concentrating on these corporate earnings or dismal economic data points, market participants were too focused on the “pillow talk” about decent payroll data from the U.S. Federal Reserve.

Read more at http://investmentwatchblog.com/the-us-recovery-story-is-a-fraud-the-reality-is-that-the-vast-bulk-of-economic-as-well-as-earnings-data-has-been-simply-dreadful/#QUvgvB4ctfv7zqim.99