HOW MUCH MONEY DO THE TOP INCOME EARNERS MAKE?

Financial Samurai

Americans are rich by world standards. With an average per capita income of ~$48,000, America ranks in the Top 10 in the world. The other nine include Qatar ($88,300), Luxembourg ($80,000), Singapore ($57,230), Norway ($52,230), Brunei ($47,500), Hong Kong ($45,000), Switzerland ($41,800), Netherlands ($40,800), Australia ($39,632), and Austria ($39,100). The data comes from the IMF (2011), and the World Bank and CIA World Factbook collect and corroborate similar data.

If at birth, you had the mental capacity to choose where you’d like to live for most of your life, one of these 10 countries should probably be on your list thanks to proper infrastructure which allows for opportunity. Even if you end up being the most mediocre producer, you are still miles ahead of much of the world. Too bad many of us can’t pick where we want to grow up and earn a living. As such, it’s nice to understand how we compare against the rest of the world to give us some perspective.

If everybody earns $1 million a year, being a millionaire isn’t very special anymore. At the same time, if everybody earns under $20,000 a year, the income level for poverty must be redefined. Everything is relative. Let’s learn about each others’ incomes shall we?

WHAT THE TOP 1%, 5%, 10%, 25% and 50% MAKE IN AMERICA

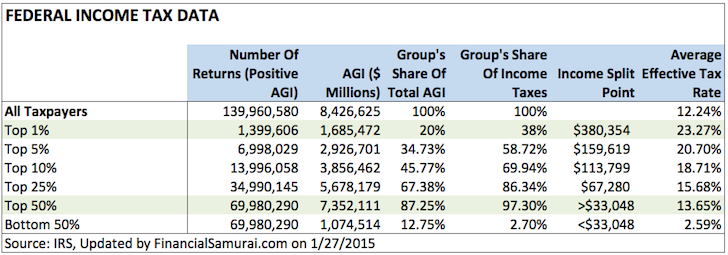

Based on the Internal Revenue Service’s 2014 database below, here’s how much the top Americans make:

Top 1%: $380,354

Top 5%: $159,619

Top 10%: $113,799

Top 25%: $67,280

Top 50%: >$33,048

SUMMARY OF FEDERAL INDIVIDUAL INCOME TAX DATA

Based on a previous 1000+ survey study on Financial Samurai in Fall 2014, about 80% of readers are in the Top 25% ($67,000+). Good to know that many of you are doing well. The table also tells us a number of things about equality or inequality, namely that the top 1% of tax payers pay 38% of all income taxes yet only have a 20% share of total AGI. Furthermore, the top 50% of tax payers pay practically all of the nation’s federal taxes (97.3%) while commanding 87.25% of total AGI. This table from the IRS is the source for the often politically bantered argument that 47% of American income earners pay zero federal income taxes.

If you do another little exercise and compare the top 25% of American income to the Top 10 per capita income countries in the world, you can once again see how lucky most of us are. If only we could get all American wage earns to pay some taxes, it would go a long way to help shoring up our budget. Congress constantly holds the nation hostage by bickering over whether to cut $10 billion here, $50 billion there. All we have to do is make those who earn above the poverty line who pay no federal income taxes pay just $43 a month and we’d raise $60 billion a year right there for example!

Let’s have everyone contribute to the welfare of our country. We are all in this together! For those who are just struggling to keep their heads above water, let’s lend them a helping hand.

WHO ARE THE 47% WHO PAY NO FEDERAL INCOME TAXES?

The Tax Policy Center’s Donald Marron said they fall into three main groups:

The working poor. The earned income tax credit and the child credit can help families making $50,000 or more pay no taxes or get money back. About 60% of those not paying income taxes do contribute to payroll taxes, meaning they must have some source of earned income.

The elderly. An increased standard deduction for those over 65, and an exemption on part of Social Security earnings, means that many older Americans pay no income taxes. Please remember though that the elderly have paid their dues through decades worth of federal taxation during their careers.

The low-income. A family of four claiming only the standard deduction and personal exemptions pays no federal income tax on its first $27,000 of income.

As you can see, being poor or elderly likely means you don’t pay net federal income taxes. We’re all going to grow old one day, so let’s give this group a pass. The elderly paid into the system, so let’s take care of them. I don’t think any of us would rather be poor so we can pay no federal taxes, so let’s give them a pass too. This leaves us with a low-income group that may have made some suboptimal decisions such as having children while not being able to support themselves. Children are estimated to cost anywhere from $100,000 to $500,000 from the ages of 1-18. Perhaps having multiple children on a low income is not ideal. But, how do you deny passion?

NO REASON TO EVER COMPLAIN

If you work in America, you can see from a top down and bottoms up perspective you’re doing fantastic. If you are in the bottom 50% of Americans who earn less than $33,048 a year, know that you can earn more if you want to. Half the battle is just moving to a vibrant location such as the San Francisco Bay Area where billions of dollars are flowing in due to technology innovation. It’s not like you have to brave the high seas to reach America. It’s not like you need to ride a horse for three months to get from New York to get to California. All you’ve got to do is hop on a bus or a plane to be where the action is!

I remember making $550 a month working at McDonald’s for $3.5/hour, 20 years ago. With wages 3X higher now, I’d be pulling in $$1,650 a month or $20,000 a year! Tack on another side hustle that pays $1,200 a month and I’m in the top 50%. So where are these side hustles you say? You can find a plethora of opportunities on sites like Craigslist.

If you are only working 40 hours a week or less and complaining why you can’t get ahead, you need to seriously re-evaluate your work ethic and expectations. Anybody can do it, you just can’t be delusional enough to think that you’ll be able to compete, when everybody in the world who wants to get ahead is working 60+ hours a week and getting paid much less to boot! Spend some time online understanding global wages from our biggest competitors in China and India. In order to maintain or incomes, we must constantly be updating our skills.

There are plenty of six figure jobs out there for the taking. You just need to have the desire, motivation, work ethic, and perseverance to get there. Did you know the San Francisco police chief makes $320,000 a year? Furthermore, when he retires, he’ll probably get a $200,000 a year pension for life! It’s not just doctors, lawyers, venture capitalists, bankers, movie stars and athletes who make healthy sums of money. Even my friend who is a union electrician who is not allowed to work more than 35 hours a week makes $120,000 a year and gets a $5,000 a month pension when he retires at 55. Let’s not count the $30,000 a year he makes doing side jobs with all that free time. There are six figure earners in practically every single industry, including the non-profit industry!

Back to my point where if everybody earns a million dollars a year, nobody is rich. Living in San Francisco, it certainly feels like most are in the top 5% of income earners ($159,619). I’m sure many who live and work in Manhattan, and potentially LA and Chicago feel the same way. The cost of living is expensive out here, and that’s predominantly driven by high wages. Combine two income earners with these amounts, and you can really start understanding why surpassing what the government deems as wealthy ($250,000) is so easy.

LET’S THANK THE RICH FOR ALWAYS PAYING MORE

As the economy continues to recover in 2015, it’s likely that the top 1% of income earners will likely pay an even higher percentage share of overall income taxes than their share of income justifies. If things were fair, the top 1% would only have to pay 20% of total income taxes since 20% is their share of total income. Alas, the rich pay almost double what they owe.

On the flip side, the bottom 50% who earn 12.75% of total earnings only pay 2.7% in total taxes. But, as we learned above most of the bottom 50% are elderly or poor. Just how protesters wrongly group together the top 1% who make over $380,000 with the ultra rich who make millions of dollars a year, zealots are also grouping together those earning ~$30,000 a year with the most destitute!

Inequality is wrong. If you are being terrorized by the IRS or protected by the nation’s military from nuclear war, you should pay taxes. If you get to drive on interstate highways, you should pay taxes. Discrimination is not OK, just because you aren’t being discriminated against. In other words, it’s not right to always go after a group of income earners who already pay the most federal income taxes already if you don’t pay any taxes, or aren’t willing to pay more taxes yourself!

If we can increase the breadth of tax collection by our spendthrift government, we will ensure that every citizen has a vested interest in moving our country forward. Trying to squeeze people even more when you’re paying little to no taxes very is a throwback to tyranny.

Let’s stop demonizing the top income earners. Instead, how about just being appreciative of those who pay the most taxes, donate the most to charity, and hire the most people? Always fight for equality. It will set us free!

Recommended Actions For Increasing Your Wealth

Manage Your Finances In One Place: The best way to build wealth is to get a handle on your finances by signing up with Personal Capital. They are a free online software which aggregates all your financial accounts in one place so you can see where you can optimize. Before Personal Capital, I had to log into eight different systems to track 28 different accounts (brokerage, multiple banks, 401K, etc) to manage my finances. Now, I can just log into Personal Capital to see how my stock accounts are doing, how my net worth is progressing, and where my spending is going.

The best feature is the free 401K Fee Analyzer which has saved me over $1,700 a year in portfolio fees I had no idea I was paying. They also have a free Investment Checkup tool which analyzes your portfolio for risk. Personal Capital takes less than one minute to sign up and is the most valuable tool I’ve found to help people achieve financial independence.

Check Your Credit Score: Everybody needs to check their credit score once every six months given the risk of identity theft and the fact that 30% of credit scores have errors. For over a year, I thought I had a 790ish credit score and was fine, until my mortgage refinance bank on day 80 of my refinance told me they could not go through due to a $8 late payment by my tenants from two years ago! My credit score was hit by 110 points to 680 and I could not get the lowest rate! I had to spend an extra 10 days fixing my score by contacting the utility company to write a “Clear Credit Letter” to get the bank to follow through. Check your credit score for free at GoFreeCredit.com and protect yourself. The averaged credit score for a rejected mortgage applicant is 729!

Thoroughly updated on 1/27/2015. Make 2015 and beyond the year you make more money, save more cash, and grow your net worth by taking control of your finances!

Photo: President Obama and His Dog, Public Domain.

Best,

Sam

- See more at: http://www.financialsamurai.com/how-much-money-do-the-top-income-earners-make-percent/#sthash.M56UVADd.dpuf

Americans are rich by world standards. With an average per capita income of ~$48,000, America ranks in the Top 10 in the world. The other nine include Qatar ($88,300), Luxembourg ($80,000), Singapore ($57,230), Norway ($52,230), Brunei ($47,500), Hong Kong ($45,000), Switzerland ($41,800), Netherlands ($40,800), Australia ($39,632), and Austria ($39,100). The data comes from the IMF (2011), and the World Bank and CIA World Factbook collect and corroborate similar data.

If at birth, you had the mental capacity to choose where you’d like to live for most of your life, one of these 10 countries should probably be on your list thanks to proper infrastructure which allows for opportunity. Even if you end up being the most mediocre producer, you are still miles ahead of much of the world. Too bad many of us can’t pick where we want to grow up and earn a living. As such, it’s nice to understand how we compare against the rest of the world to give us some perspective.

If everybody earns $1 million a year, being a millionaire isn’t very special anymore. At the same time, if everybody earns under $20,000 a year, the income level for poverty must be redefined. Everything is relative. Let’s learn about each others’ incomes shall we?

WHAT THE TOP 1%, 5%, 10%, 25% and 50% MAKE IN AMERICA

Based on the Internal Revenue Service’s 2014 database below, here’s how much the top Americans make:

Top 1%: $380,354

Top 5%: $159,619

Top 10%: $113,799

Top 25%: $67,280

Top 50%: >$33,048

SUMMARY OF FEDERAL INDIVIDUAL INCOME TAX DATA

Based on a previous 1000+ survey study on Financial Samurai in Fall 2014, about 80% of readers are in the Top 25% ($67,000+). Good to know that many of you are doing well. The table also tells us a number of things about equality or inequality, namely that the top 1% of tax payers pay 38% of all income taxes yet only have a 20% share of total AGI. Furthermore, the top 50% of tax payers pay practically all of the nation’s federal taxes (97.3%) while commanding 87.25% of total AGI. This table from the IRS is the source for the often politically bantered argument that 47% of American income earners pay zero federal income taxes.

If you do another little exercise and compare the top 25% of American income to the Top 10 per capita income countries in the world, you can once again see how lucky most of us are. If only we could get all American wage earns to pay some taxes, it would go a long way to help shoring up our budget. Congress constantly holds the nation hostage by bickering over whether to cut $10 billion here, $50 billion there. All we have to do is make those who earn above the poverty line who pay no federal income taxes pay just $43 a month and we’d raise $60 billion a year right there for example!

Let’s have everyone contribute to the welfare of our country. We are all in this together! For those who are just struggling to keep their heads above water, let’s lend them a helping hand.

WHO ARE THE 47% WHO PAY NO FEDERAL INCOME TAXES?

The Tax Policy Center’s Donald Marron said they fall into three main groups:

The working poor. The earned income tax credit and the child credit can help families making $50,000 or more pay no taxes or get money back. About 60% of those not paying income taxes do contribute to payroll taxes, meaning they must have some source of earned income.

The elderly. An increased standard deduction for those over 65, and an exemption on part of Social Security earnings, means that many older Americans pay no income taxes. Please remember though that the elderly have paid their dues through decades worth of federal taxation during their careers.

The low-income. A family of four claiming only the standard deduction and personal exemptions pays no federal income tax on its first $27,000 of income.

As you can see, being poor or elderly likely means you don’t pay net federal income taxes. We’re all going to grow old one day, so let’s give this group a pass. The elderly paid into the system, so let’s take care of them. I don’t think any of us would rather be poor so we can pay no federal taxes, so let’s give them a pass too. This leaves us with a low-income group that may have made some suboptimal decisions such as having children while not being able to support themselves. Children are estimated to cost anywhere from $100,000 to $500,000 from the ages of 1-18. Perhaps having multiple children on a low income is not ideal. But, how do you deny passion?

NO REASON TO EVER COMPLAIN

If you work in America, you can see from a top down and bottoms up perspective you’re doing fantastic. If you are in the bottom 50% of Americans who earn less than $33,048 a year, know that you can earn more if you want to. Half the battle is just moving to a vibrant location such as the San Francisco Bay Area where billions of dollars are flowing in due to technology innovation. It’s not like you have to brave the high seas to reach America. It’s not like you need to ride a horse for three months to get from New York to get to California. All you’ve got to do is hop on a bus or a plane to be where the action is!

I remember making $550 a month working at McDonald’s for $3.5/hour, 20 years ago. With wages 3X higher now, I’d be pulling in $$1,650 a month or $20,000 a year! Tack on another side hustle that pays $1,200 a month and I’m in the top 50%. So where are these side hustles you say? You can find a plethora of opportunities on sites like Craigslist.

If you are only working 40 hours a week or less and complaining why you can’t get ahead, you need to seriously re-evaluate your work ethic and expectations. Anybody can do it, you just can’t be delusional enough to think that you’ll be able to compete, when everybody in the world who wants to get ahead is working 60+ hours a week and getting paid much less to boot! Spend some time online understanding global wages from our biggest competitors in China and India. In order to maintain or incomes, we must constantly be updating our skills.

There are plenty of six figure jobs out there for the taking. You just need to have the desire, motivation, work ethic, and perseverance to get there. Did you know the San Francisco police chief makes $320,000 a year? Furthermore, when he retires, he’ll probably get a $200,000 a year pension for life! It’s not just doctors, lawyers, venture capitalists, bankers, movie stars and athletes who make healthy sums of money. Even my friend who is a union electrician who is not allowed to work more than 35 hours a week makes $120,000 a year and gets a $5,000 a month pension when he retires at 55. Let’s not count the $30,000 a year he makes doing side jobs with all that free time. There are six figure earners in practically every single industry, including the non-profit industry!

Back to my point where if everybody earns a million dollars a year, nobody is rich. Living in San Francisco, it certainly feels like most are in the top 5% of income earners ($159,619). I’m sure many who live and work in Manhattan, and potentially LA and Chicago feel the same way. The cost of living is expensive out here, and that’s predominantly driven by high wages. Combine two income earners with these amounts, and you can really start understanding why surpassing what the government deems as wealthy ($250,000) is so easy.

LET’S THANK THE RICH FOR ALWAYS PAYING MORE

As the economy continues to recover in 2015, it’s likely that the top 1% of income earners will likely pay an even higher percentage share of overall income taxes than their share of income justifies. If things were fair, the top 1% would only have to pay 20% of total income taxes since 20% is their share of total income. Alas, the rich pay almost double what they owe.

On the flip side, the bottom 50% who earn 12.75% of total earnings only pay 2.7% in total taxes. But, as we learned above most of the bottom 50% are elderly or poor. Just how protesters wrongly group together the top 1% who make over $380,000 with the ultra rich who make millions of dollars a year, zealots are also grouping together those earning ~$30,000 a year with the most destitute!

Inequality is wrong. If you are being terrorized by the IRS or protected by the nation’s military from nuclear war, you should pay taxes. If you get to drive on interstate highways, you should pay taxes. Discrimination is not OK, just because you aren’t being discriminated against. In other words, it’s not right to always go after a group of income earners who already pay the most federal income taxes already if you don’t pay any taxes, or aren’t willing to pay more taxes yourself!

If we can increase the breadth of tax collection by our spendthrift government, we will ensure that every citizen has a vested interest in moving our country forward. Trying to squeeze people even more when you’re paying little to no taxes very is a throwback to tyranny.

Let’s stop demonizing the top income earners. Instead, how about just being appreciative of those who pay the most taxes, donate the most to charity, and hire the most people? Always fight for equality. It will set us free!

Recommended Actions For Increasing Your Wealth

Manage Your Finances In One Place: The best way to build wealth is to get a handle on your finances by signing up with Personal Capital. They are a free online software which aggregates all your financial accounts in one place so you can see where you can optimize. Before Personal Capital, I had to log into eight different systems to track 28 different accounts (brokerage, multiple banks, 401K, etc) to manage my finances. Now, I can just log into Personal Capital to see how my stock accounts are doing, how my net worth is progressing, and where my spending is going.

The best feature is the free 401K Fee Analyzer which has saved me over $1,700 a year in portfolio fees I had no idea I was paying. They also have a free Investment Checkup tool which analyzes your portfolio for risk. Personal Capital takes less than one minute to sign up and is the most valuable tool I’ve found to help people achieve financial independence.

Check Your Credit Score: Everybody needs to check their credit score once every six months given the risk of identity theft and the fact that 30% of credit scores have errors. For over a year, I thought I had a 790ish credit score and was fine, until my mortgage refinance bank on day 80 of my refinance told me they could not go through due to a $8 late payment by my tenants from two years ago! My credit score was hit by 110 points to 680 and I could not get the lowest rate! I had to spend an extra 10 days fixing my score by contacting the utility company to write a “Clear Credit Letter” to get the bank to follow through. Check your credit score for free at GoFreeCredit.com and protect yourself. The averaged credit score for a rejected mortgage applicant is 729!

Thoroughly updated on 1/27/2015. Make 2015 and beyond the year you make more money, save more cash, and grow your net worth by taking control of your finances!

Photo: President Obama and His Dog, Public Domain.

Best,

Sam

- See more at: http://www.financialsamurai.com/how-much-money-do-the-top-income-earners-make-percent/#sthash.M56UVADd.dpufAmericans are rich by world standards. With an average per capita income of ~$48,000, America ranks in the Top 10 in the world. The other nine include Qatar ($88,300), Luxembourg ($80,000), Singapore ($57,230), Norway ($52,230), Brunei ($47,500), Hong Kong ($45,000), Switzerland ($41,800), Netherlands ($40,800), Australia ($39,632), and Austria ($39,100). The data comes from the IMF (2011), and the World Bank and CIA World Factbook collect and corroborate similar data.

If at birth, you had the mental capacity to choose where you’d like to live for most of your life, one of these 10 countries should probably be on your list thanks to proper infrastructure which allows for opportunity. Even if you end up being the most mediocre producer, you are still miles ahead of much of the world. Too bad many of us can’t pick where we want to grow up and earn a living. As such, it’s nice to understand how we compare against the rest of the world to give us some perspective.

If everybody earns $1 million a year, being a millionaire isn’t very special anymore. At the same time, if everybody earns under $20,000 a year, the income level for poverty must be redefined. Everything is relative. Let’s learn about each others’ incomes shall we?

WHAT THE TOP 1%, 5%, 10%, 25% and 50% MAKE IN AMERICA

Based on the Internal Revenue Service’s 2014 database below, here’s how much the top Americans make:

Top 1%: $380,354

Top 5%: $159,619

Top 10%: $113,799

Top 25%: $67,280

Top 50%: >$33,048

SUMMARY OF FEDERAL INDIVIDUAL INCOME TAX DATA

Based on a previous 1000+ survey study on Financial Samurai in Fall 2014, about 80% of readers are in the Top 25% ($67,000+). Good to know that many of you are doing well. The table also tells us a number of things about equality or inequality, namely that the top 1% of tax payers pay 38% of all income taxes yet only have a 20% share of total AGI. Furthermore, the top 50% of tax payers pay practically all of the nation’s federal taxes (97.3%) while commanding 87.25% of total AGI. This table from the IRS is the source for the often politically bantered argument that 47% of American income earners pay zero federal income taxes.

If you do another little exercise and compare the top 25% of American income to the Top 10 per capita income countries in the world, you can once again see how lucky most of us are. If only we could get all American wage earns to pay some taxes, it would go a long way to help shoring up our budget. Congress constantly holds the nation hostage by bickering over whether to cut $10 billion here, $50 billion there. All we have to do is make those who earn above the poverty line who pay no federal income taxes pay just $43 a month and we’d raise $60 billion a year right there for example!

Let’s have everyone contribute to the welfare of our country. We are all in this together! For those who are just struggling to keep their heads above water, let’s lend them a helping hand.

WHO ARE THE 47% WHO PAY NO FEDERAL INCOME TAXES?

The Tax Policy Center’s Donald Marron said they fall into three main groups:

The working poor. The earned income tax credit and the child credit can help families making $50,000 or more pay no taxes or get money back. About 60% of those not paying income taxes do contribute to payroll taxes, meaning they must have some source of earned income.

The elderly. An increased standard deduction for those over 65, and an exemption on part of Social Security earnings, means that many older Americans pay no income taxes. Please remember though that the elderly have paid their dues through decades worth of federal taxation during their careers.

The low-income. A family of four claiming only the standard deduction and personal exemptions pays no federal income tax on its first $27,000 of income.

As you can see, being poor or elderly likely means you don’t pay net federal income taxes. We’re all going to grow old one day, so let’s give this group a pass. The elderly paid into the system, so let’s take care of them. I don’t think any of us would rather be poor so we can pay no federal taxes, so let’s give them a pass too. This leaves us with a low-income group that may have made some suboptimal decisions such as having children while not being able to support themselves. Children are estimated to cost anywhere from $100,000 to $500,000 from the ages of 1-18. Perhaps having multiple children on a low income is not ideal. But, how do you deny passion?

NO REASON TO EVER COMPLAIN

If you work in America, you can see from a top down and bottoms up perspective you’re doing fantastic. If you are in the bottom 50% of Americans who earn less than $33,048 a year, know that you can earn more if you want to. Half the battle is just moving to a vibrant location such as the San Francisco Bay Area where billions of dollars are flowing in due to technology innovation. It’s not like you have to brave the high seas to reach America. It’s not like you need to ride a horse for three months to get from New York to get to California. All you’ve got to do is hop on a bus or a plane to be where the action is!

I remember making $550 a month working at McDonald’s for $3.5/hour, 20 years ago. With wages 3X higher now, I’d be pulling in $$1,650 a month or $20,000 a year! Tack on another side hustle that pays $1,200 a month and I’m in the top 50%. So where are these side hustles you say? You can find a plethora of opportunities on sites like Craigslist.

If you are only working 40 hours a week or less and complaining why you can’t get ahead, you need to seriously re-evaluate your work ethic and expectations. Anybody can do it, you just can’t be delusional enough to think that you’ll be able to compete, when everybody in the world who wants to get ahead is working 60+ hours a week and getting paid much less to boot! Spend some time online understanding global wages from our biggest competitors in China and India. In order to maintain or incomes, we must constantly be updating our skills.

There are plenty of six figure jobs out there for the taking. You just need to have the desire, motivation, work ethic, and perseverance to get there. Did you know the San Francisco police chief makes $320,000 a year? Furthermore, when he retires, he’ll probably get a $200,000 a year pension for life! It’s not just doctors, lawyers, venture capitalists, bankers, movie stars and athletes who make healthy sums of money. Even my friend who is a union electrician who is not allowed to work more than 35 hours a week makes $120,000 a year and gets a $5,000 a month pension when he retires at 55. Let’s not count the $30,000 a year he makes doing side jobs with all that free time. There are six figure earners in practically every single industry, including the non-profit industry!

Back to my point where if everybody earns a million dollars a year, nobody is rich. Living in San Francisco, it certainly feels like most are in the top 5% of income earners ($159,619). I’m sure many who live and work in Manhattan, and potentially LA and Chicago feel the same way. The cost of living is expensive out here, and that’s predominantly driven by high wages. Combine two income earners with these amounts, and you can really start understanding why surpassing what the government deems as wealthy ($250,000) is so easy.

LET’S THANK THE RICH FOR ALWAYS PAYING MORE

As the economy continues to recover in 2015, it’s likely that the top 1% of income earners will likely pay an even higher percentage share of overall income taxes than their share of income justifies. If things were fair, the top 1% would only have to pay 20% of total income taxes since 20% is their share of total income. Alas, the rich pay almost double what they owe.

On the flip side, the bottom 50% who earn 12.75% of total earnings only pay 2.7% in total taxes. But, as we learned above most of the bottom 50% are elderly or poor. Just how protesters wrongly group together the top 1% who make over $380,000 with the ultra rich who make millions of dollars a year, zealots are also grouping together those earning ~$30,000 a year with the most destitute!

Inequality is wrong. If you are being terrorized by the IRS or protected by the nation’s military from nuclear war, you should pay taxes. If you get to drive on interstate highways, you should pay taxes. Discrimination is not OK, just because you aren’t being discriminated against. In other words, it’s not right to always go after a group of income earners who already pay the most federal income taxes already if you don’t pay any taxes, or aren’t willing to pay more taxes yourself!

If we can increase the breadth of tax collection by our spendthrift government, we will ensure that every citizen has a vested interest in moving our country forward. Trying to squeeze people even more when you’re paying little to no taxes very is a throwback to tyranny.

Let’s stop demonizing the top income earners. Instead, how about just being appreciative of those who pay the most taxes, donate the most to charity, and hire the most people? Always fight for equality. It will set us free!

Recommended Actions For Increasing Your Wealth

Manage Your Finances In One Place: The best way to build wealth is to get a handle on your finances by signing up with Personal Capital. They are a free online software which aggregates all your financial accounts in one place so you can see where you can optimize. Before Personal Capital, I had to log into eight different systems to track 28 different accounts (brokerage, multiple banks, 401K, etc) to manage my finances. Now, I can just log into Personal Capital to see how my stock accounts are doing, how my net worth is progressing, and where my spending is going.

The best feature is the free 401K Fee Analyzer which has saved me over $1,700 a year in portfolio fees I had no idea I was paying. They also have a free Investment Checkup tool which analyzes your portfolio for risk. Personal Capital takes less than one minute to sign up and is the most valuable tool I’ve found to help people achieve financial independence.

Check Your Credit Score: Everybody needs to check their credit score once every six months given the risk of identity theft and the fact that 30% of credit scores have errors. For over a year, I thought I had a 790ish credit score and was fine, until my mortgage refinance bank on day 80 of my refinance told me they could not go through due to a $8 late payment by my tenants from two years ago! My credit score was hit by 110 points to 680 and I could not get the lowest rate! I had to spend an extra 10 days fixing my score by contacting the utility company to write a “Clear Credit Letter” to get the bank to follow through. Check your credit score for free at GoFreeCredit.com and protect yourself. The averaged credit score for a rejected mortgage applicant is 729!

Thoroughly updated on 1/27/2015. Make 2015 and beyond the year you make more money, save more cash, and grow your net worth by taking control of your finances!

Photo: President Obama and His Dog, Public Domain.

Best,

Sam

- See more at: http://www.financialsamurai.com/how-much-money-do-the-top-income-earners-make-percent/#sthash.M56UVADd.dpuf