Real inflation pegged at 8.4%?

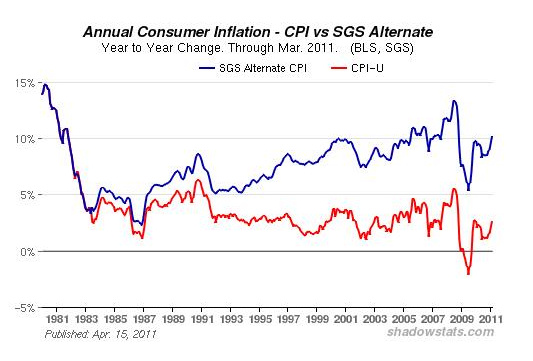

The government's Consumer Price Index recently announced that inflation over the last 12 months has been 2.7 percent, so why does there seem to be so much month left at the end of the paycheck these days?

Perhaps it's because the actual inflation – the dollars and cents that consumers have to pay to cover their living expenses, food, clothing, utilities and such – actually are well above 8 percent, not 2.7 percent. And one expert says that's not an accident.

"The reality is that we are following virtually the same economic playbook as we did 80 years ago in dealing with the Great Depression, which resulted in a false recovery, followed by the most painful contraction in U.S. history with a 25 percent unemployment rate,” says Craig Smith, of Swiss America Trading Corp. and the author of "Crashing the Dollar: How to Survive a Global Currency Collapse."

"In 1929 we decided to borrow, print and spend money that we did not have in order to prompt a 'recovery.' It didn't work then and it will not work now. In my opinion it is going to take not only a credit downgrade, but the potential loss of the U.S. dollar's Global Reserve Currency status before the proper decisions are made to address the underlying problems."

May 11, 2011