THE 'REAL 'TERRORISTS' ARE IN WASHINGTON

Bill Bonner's diary

Elizabeth received a strange letter from her congressman.

“We have to be on guard against our enemies… and not be afraid to name them.”

A brave, forthright stand?

But wait, he didn’t name the enemies.

Preposterous Lies

That left us wondering: Who are our enemies?

Muslims, Jews, Arabs… Russians, Iranians, North Koreans… capitalists, the Deep State, Yankees… liberals, conservatives?

And what does he mean by “our”?

A politician’s enemies are more likely to be our friends than our enemies. Our most dangerous enemies could be the feds themselves!

But people love simple and preposterous lies. They much prefer them to the truth.

Truth is elusive. Difficult to discover. Infinitely nuanced. Hard to hold onto. Each tiny bit of truth comes at a high price: A love lost. A marriage ruined. A business bankrupt. Money wasted. And a sorry soul burning on some ash pit in Hell.

Nor does truth make you feel good. Like a magnifying mirror, it shows blemishes. You squirm in your seat when you see it. Often, you want to turn off the lights.

Not so with myth. It comes right over to you, fawns over you, airbrushes your photo, and Botoxes your face. It flatters you with weak light and strong angles.

It pretends you are the noble master and it is merely the humble slave… willing to do your bidding.

Myth of the “Enemy”

Today and tomorrow (unless we get distracted), we will look at popular myths.

The myth of the “enemy” is always a hit with the masses.

Politicians love it, too. It encourages taxpayers to turn over more of their wages – for their own protection, of course.

It invites citizens to give up their liberties – in this time of grave danger!

It rousts up the population to think and act with a single mind… united to meet the common foe, under the brave and unflinching leadership of our patriotic politicians.

And woe to the person who resists. He is “soft” on our enemies. Or an outright traitor.

If you believe the polls, millions of Americans will choose their next president based on which one will do a better job of protecting them from terrorists.

Apparently, terrorists – particularly foreign-born terrorists – pose a substantial threat.

Of course, there are always terrorists…

Robespierre invented the term when he referred to himself by that word. By then, Terror had become official policy in Revolutionary France, proclaimed by the National Convention on September 5, 1793:

It is time that equality bore its scythe above all heads. It is time to horrify all the conspirators. So legislators, place Terror on the order of the day! Let us be in revolution, because everywhere counter-revolution is being woven by our enemies. The blade of the law should hover over all the guilty.

There are always people who are willing to use violence in pursuit of political ends. After all, that’s the name of the game.

No Credible Threat

Violence is what politics is all about…

If no violence were involved, it would be no different from the rest of life – with its give and take, its persuasion, its bargaining, its negotiating, and its civilized commerce.

Without violence, a meeting of the Committee of Public Safety in 1793, or a Joint Session of Congress in 2016, would have no more importance than, say, a gathering of the Kiwanis Club or Elvis impersonators.

Politics is different. The politician – no matter how mild-mannered – always has a loaded gun in his britches. The terrorist merely brings it out and waves it around.

From Zionist zealots in Judea… to the Sons of Liberty in Boston… to Irish irredentists blowing up London subway stops… to the KKK in the South after the War Between the States.

In 1920, the IRA attacked over 300 police stations – symbols of British rule – and killed a dozen policemen. They also burned down the docks at Liverpool.

In 1946, the Irgun blew up the King David Hotel, killing 91 people. The head of the group, Menachem Begin, went on to become prime minister of Israel.

Germany’s Red Army Faction launched 296 bomb attacks – in addition to assassinations, kidnappings, arson, bank robberies, and shootouts with the police.

But wait. What’s this? What about all those millions of terrorists who want to attack us? Are these foreigners really worth worrying about?

Here’s immigration policy analyst Alex Nowrasteh at the Cato Institute:

In a new analysis I just published at the Cato Institute, I look at every single terrorist attack committed on U.S. soil by an immigrant or tourist from 1975 to the end of 2015 and apply some basic risk analysis.

Turns out, Americans should not be so worried: The chance of being killed in a terrorist attack committed by a foreigner is about 1 in 3.6 million per year.

And the numbers are skewed by one outlier event – 9/11. That single attack accounts for 98.6% of all the people killed on U.S. soil by foreign-born terrorists in the past 41 years.

Worry about terrorists?

It’s hard to believe there aren’t greater threats lurking somewhere else.

Regards,

|

|

Bill

Further Reading: The greatest threat is lurking right here at home, strolling the halls of the Capitol Building or ambling down Wall Street. It’s the Deep State – a shadowy group of unelected officials that wields true control over most aspects of American life. Yet most people have no clue it even exists.

That’s why Bill recorded a special presentation to warn every citizen about the dark side of American power… and you can listen to his spine-tingling tale here.

Investor Focus

By Chris Mayer, Chief Investment Strategist, Bonner Private Portfolio

There are several stock categories that can return 100 times your money…

I call these stocks “100 baggers.” And some of the most overlooked are young restaurant stocks.

Peter Lynch, who ran Fidelity’s Magellan Fund and is one of the greatest investors of all time, had a whole chapter on restaurant stocks in his classic book Beating the Street (1993).

I still have my original hardcover, which I’ve read a number of times. It had a big impact on me when it came out. I was just out of college and trying to figure out this investing game.

In his book, Lynch talked about how every region of the country incubates some small chain that goes on to have national success. He cites a number of big winners in his book: Shoney’s (168-bagger), Bob Evans (83-bagger), Kentucky Fried Chicken (27-bagger), and many more.

Of course, restaurant stocks can get stale. But when they begin their march across the country, they can be wonderful investments.

Right now may be a particularly good time to look because many restaurant stocks are having a hard time. Sales growth is slowing or has even gone slightly negative. And higher labor costs are crimping profit margins.

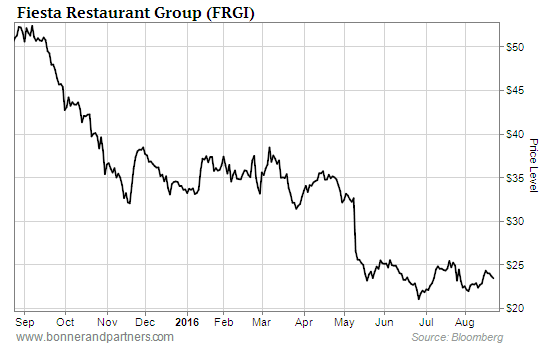

So, many of the stock prices have come down. They’re not trading at the big valuations they often command. Take a look at Fiesta Restaurant Group (FRGI), for example. It owns two small regional restaurants, Pollo Tropical and Taco Cabana.

|

After hitting $55 per share, where it traded for more than 33x earnings, it’s been more than cut in half. It now trades for 17x earnings. The sizzle is out of the stock, but the appealing economics remain…

FRGI earns about a 25% cash-on-cash return when it opens a new restaurant. (Meaning if it opens a new location for a cost of $2 million, it’ll earn a $500K annual profit on that location.) Darn good.

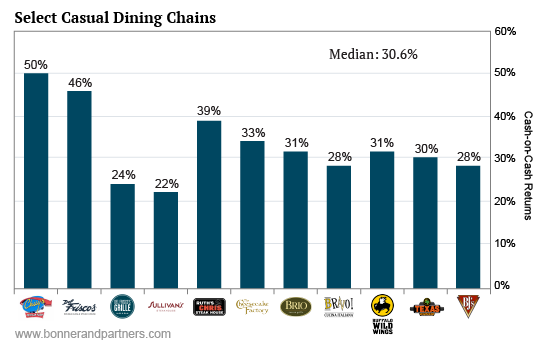

And that’s not unusual. Here’s a cherry-picked group of restaurants in the so-called casual dining space. You can see the median cash-on-cash returns for the group is 30%:

|

I’m not saying all these stocks are buys. I’m saying that restaurant stocks are an interesting place to fish for big winners.

Restaurant stocks face macro headwinds today – slumping sales growth and rising labor costs – but they won’t forever.

While it’s true the restaurant business has had more than its share of busts, if you stick with stocks that have excellent economics and you don’t over-pay, you tilt the odds in your favor. It worked for Lynch for decades… and it’s still a good concept today.

Editor’s Note: As many of you know, Chris is one of the best stock-pickers in the business. And he’s hosting a brand-new investment masterclass…

In this series of short training videos, Chris will walk you through the blueprint he developed to find stocks with Starbucks or Apple potential… long before Wall Street is paying any attention to them.

And to prove how effective this method is, he’s going to share six stocks from his Watch List with you – so you can see for yourself if they behave the way he says they will.

Chris’s FREE masterclass starts next Monday, September 19. To make sure you don’t miss a minute, click here to register.

Featured Reads

Triggers for a Global Economic Meltdown

All signs point to a coming global meltdown. And a legendary international investor says one particular country is at the epicenter of several potential crises that will spark this worldwide disaster…

Could a Computer Replace Janet Yellen at the Fed?

Economist Milton Friedman was in favor of replacing the Federal Reserve with a computer. Maybe he was on to something. If money supply were controlled by an algorithm, we might all be better off.

How Buffett Beat the Hedge Funds

Billionaire investor Warren Buffett will almost certainly win his 2007 bet that, for the ensuing decade, the S&P 500 would outdo a hand-picked group of hedge funds. Here’s why Buffett’s bet was a no-brainer.

Mailbag

Yesterday’s Diary about Janet Yellen’s shame was a big hit with readers…

Thank you for being pure awesome… clear, concise, and spot-on. I’ve yet to read a more accurate explanation of the Fed’s nefarious nature and the knaves that continue to perpetrate this economic atrocity against us.

– Jake S.

Further to the government benefitting from artificially driving up the stock market. That occurred concurrently with a jump in capital gains tax from 15% to 28%. Those drawn into the market found their dividend tax went from 15% to 39.6%. In case one happens to die with new stock market wealth, the estate tax went from 0% to 55%. And if someone chooses to invest his market gains in a new home, a 3.5% real estate transaction tax was added.

More government of the people – by the politicos and cronies, and for the easy money it provides.

– Kent A.

Bill Bonner’s Sept. 14 commentary is one of the best he has ever written. I totally agree with his opinions re the present financial situation and his predictions for the future. Great article.

– Eddie B.

I really enjoy your newsletters. I sincerely look forward to getting them.

– Michael C.

And judging by the following reader responses, so was Tuesday’s Diary about the insanity of negative interest rates…

I read and enjoy your Diary every day. Thanks. But I have to let you know that I found your September 13 offering absolutely brilliant. How you do it I don’t know. Keep it up.

– Peter A.

Negative interest rates, negative-yielding bonds, Hillary is near death, “The Donald” in on the rise, al-Qaeda is making a comeback, Erdogan thinks he’s Ataturk, the Kurds want a country of their own, Sarkozy is back in the news in France, football players are not standing for the national anthem, the stock market is ready to tank, Russia is rebranding Lennon to attract the younger generation, Black Lives Matter, Assad thinks he is misjudged, Kim Jong-un is sowing his oats, the originarios, floods in Louisiana, and Ryan Lochte is on Dancing with the Stars….

Armageddon is upon us, give me a beer and a front row seat… this is awesome!

– Doug S.

In Case You Missed It…

What: Free Investment Masterclass on how to identify tomorrow’s biggest stock market winners today.

When: Monday, September 19 – Thursday, September 22

Who: Chris Mayer – the only analyst Bill follows with his own family money.

Where: A private website you can access when you register here.

Special Bonus: All attendees get the names of six stocks from Chris Mayer’s private Watch List.

http://bonnerandpartners.com/the-real-terrorists-are-in-washington/