Cellphonemania: Why is the U.S. Justice Department in this Image?

Katherine Smith, PhD

U.S. Sues to Stop AT&T Deal – A Surprisingly Swift Move or Disinformation?

The Justice Department’s lawsuit is most likely Disinformation … deliberately misleading information announced publicly or leaked by a government, intelligence agency or other entity for the purpose of influencing opinions or perceptions.

The antitrust action to block AT&T Inc.’s proposed $39 billion takeover of T-Mobile USA is intended to sow confusion and deceive the public about why everyone young, old, rich, poor, black, white, brown, yellow, and red … in just about every country has a cell phone. Worldwide cell phone subscriptions exceed 4.6 billion.

The government claims the combination of the second and fourth-largest cell phone companies in the U.S. would harm competition and likely raise prices for consumers.

Notice the words “likely raise prices for consumers.” [7]

AT&T has already been caught red-handed lowering prices in the face of increased demand. According to the U.S. government:

“The Government Accountability Office (GAO) released the GAO-10-77 that reported — despite reduced competition — as the $150 billion industry was consolidated by AT&T Inc, Verizon Wireless, Sprint Nextel Corp and T-Mobile USA Inc. the price of wireless phone services declined each year from ‘99 to ‘08, consolidated.

And while the GAO study reported that Wireless Industry consolidation has made it more difficult for small and regional carriers to be competitive, it found that at the same time the biggest carriers offered more services for similar or lower prices while all of the time they keep improving the coverage.” Cell Phone Plans Get Cheaper wirelessguide.org/August 26, 2010

Is this a Ubiquitous Tin Foil Hat Conspiracy? [8]

Background: Telecommunications began one hundred and fifty years ago with the advent of telegraphy. In 1843, Samuel Morse and Alfred Lewis Vail received funding from the U.S. Congress to set up and test their telegraph system between Washington, D.C., and Baltimore, Maryland. On May 24, 1844, Morse sent Vail the historic first message: “What hath God wrought!”

[from the "Lost Science" by Gerry Vassilatos]

Telegraphic installations, initially, used an earth sense-oriented technique for determining the location of the telegraph wire lines. Linesmen understood the mysterious intelligence of the earth, and the lines followed winding trails through woods, across meadows, and sinuously along ridges, lakes, and streams. The locations were based on the now long-forgotten craft for raising the vital earth energy: “Geomancy.” [Ancient societies (Atlantis) understood Geomancy. Validated in the research of Dr. Albert Abrams] [1]

Geomantic energy … the earth energy … defies quantitative analysis. It unifies metaphysical and physical entities. When the telegraph first appeared, trade journals reported an anomalous ground energy: an earth “electricity” that was energizing telegraph systems without the need for battery power. [End of excerpt from the "Lost Science" by Gerry Vassilatos] [Appendix A]

The earth energy “sense” can be found in every pagan culture. But thanks to a twist of religious dogma during the Dark Ages, most of humanity in the West was prevented from worshipping the Earth (pantheism) and instead were told that the Earth was here to serve man (monotheism).

Until the Dark Ages, the “pagans” saw themselves as part of nature and shared the view that nature was not wild and hostile but a benevolent friend.

Christianity, specifically Pauline Christology, convinced man he was the greatest and most important part of creation and that the earth needed to be tamed in the name of “progress.” Specifically, technological progress would lead to a better, happier, safer life.

From the Book of Genesis in the Holy Bible we hear,

"Let us make man in our image after our likeness: and let them have dominion over

the fish of the sea, and over the fowl of the air, and over the cattle, and over all the

earth, and over every creeping thing that creepeth upon the earth."

Of course, the operative word here is "dominion" which has been seized upon for centuries to justify all manner of environmental destruction.

Thanks to Christianity, The Powers That Be (TPTB), The Global Financial Elite (TGFE) aka The Federal Reserve and “progress,” humanity is now, according to a massive United Nations Report (the GEO4) at serious risk due to “the dangers of climate change, water scarcity, dwindling fish stocks and the pressures on the land and the extinction of species.” [2]

“The Federal Reserve isn’t evil because they print our money and make us (the U.S. taxpayers) pay interest on it. They are evil because, until October 2008, the Fed gave us a no-limit credit card that we used to buy houses, cars, RVs, TVs and DVDs—the “stuff” which put the planet at the“unknown points of no return.” [3]

Geologists and engineers, in the name of progress, used powerful machinery to cut straight paths across the landscape building houses, office buildings, freeways, and cell phone towers making it impossible for man to live in harmony with the magnetic field of the Earth. [4]

AT&T a member of the Corporatocracy

We are conditioned to believe everything is about money, power, greed and corruption. Therefore we are not aware of the great lengths to which the six companies that control 96% of the media go to sell a Corporatocracy (another non-conspiracy term) driven agenda. An agenda to make sure we never suspect that electromagnetic pollution is the goal and not the unintended consequences of cellphonemania. [5]

AT&T isn’t trying to maximize profits but is determined (supported below) to collapse the Earth’s magnetic field with a magnetic dipole field reversal. http://science.nasa.gov/science-news/science-at-nasa/2003/29dec_magneticfield/

The smart phone, a crackberry’s dream, powerful enough to send a man to the moon, is an electromagnetic nightmare for the Earth. [6]

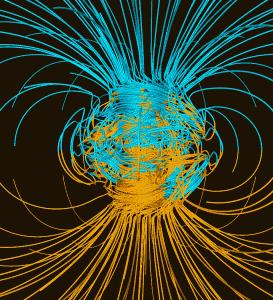

Below is the image of the Earth’s magnetic field with a healthy dipole:

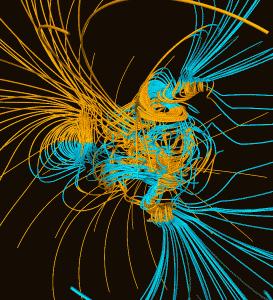

Now look at the Earth’s magnetic field when 4.6 billion humans argue on their cell phones about: how much they owe to their landlord, lovers’ quarrels, discuss in excruciating detail their own and others’ embarrassing medical conditions, details of recent real estate purchases, job triumphs, and awful dates as well as some of the most unsavory gossip. Our Cell Phones, Ourselves

Click here to read why TGFE want to twist and tangle the magnetic lines of force in the Earth’s surface and collapse the Earth’s magnetic field.

And in one of those coincidences that doesn’t happen very often, Congress passed the telecommunications Act of 1996, a milestone in the history of telecommunications, the same year that seismologists from Columbia University published evidence of super-rotation in the Earth … the inner core was rotating between 2 and 3 degrees longitude per year faster than the solid mantle and surface. The Geodynamo by Gary A Glatzmaier – Professor of Earth and Planetary Sciences, University of California, Santa Cruz

U.S. Sues to Stop AT&T Deal – A Surprisingly Swift Move or Disinformation?

The Justice Department’s lawsuit is most likely Disinformation … deliberately misleading information announced publicly or leaked by a government, intelligence agency or other entity for the purpose of influencing opinions or perceptions.

The antitrust action to block AT&T Inc.’s proposed $39 billion takeover of T-Mobile USA is intended to sow confusion and deceive the public about why everyone young, old, rich, poor, black, white, brown, yellow, and red … in just about every country has a cell phone. Worldwide cell phone subscriptions exceed 4.6 billion.

The government claims the combination of the second and fourth-largest cell phone companies in the U.S. would harm competition and likely raise prices for consumers.

Notice the words “likely raise prices for consumers.” [7]

AT&T has already been caught red-handed lowering prices in the face of increased demand. According to the U.S. government:

“The Government Accountability Office (GAO) released the GAO-10-77 that reported — despite reduced competition — as the $150 billion industry was consolidated by AT&T Inc, Verizon Wireless, Sprint Nextel Corp and T-Mobile USA Inc. the price of wireless phone services declined each year from ‘99 to ‘08, consolidated.

And while the GAO study reported that Wireless Industry consolidation has made it more difficult for small and regional carriers to be competitive, it found that at the same time the biggest carriers offered more services for similar or lower prices while all of the time they keep improving the coverage.” Cell Phone Plans Get Cheaper wirelessguide.org/August 26, 2010

Is this a Ubiquitous Tin Foil Hat Conspiracy? [8]

To suppose a conspiracy to make cell phone usage ubiquitous, in order to force the Earth to listen to the details of loved ones contacted, appointments made, arguments aired, and gossip exchanged involving JP Morgan Chase (founding member of TGFE), AT&T, Lucent, Global Crossing and WorldCom, going all the way back to 1983, when Motorola, introduced the “DynaTAC” cell phone at a cost of $3,995 (1983 dollars) is absurd in the highest degree. [9]

However, knowing that telecommunications have transformed the way we live, work, and socialize, and there are many studies on the social impact of telecommunications but none analyzing the global impact on growth, jobs, and wealth creation [Appendix C], when you consider the following:

• AT&T is only making profits on an operating basis (income less expenses) because TGFE financed and then wrote off the 1 trillion dollars it took to fund the transcontinental and transoceanic fiber-optic networks, infrastructure, as well as wireless research and development. The Great Telecom Meltdown

The TELECOM industry suffered catastrophic losses in 2003. JP Morgan Chase, the biggest loser with 46 trillion of derivative exposure [Appendix D], underwrote WorldCom and the Telecom industry and then in 2005 settled with WorldCom investors for an additional 4 billion. [10]

• An evaluation of the cell phone industry and Motorola’s business plan concluded that the company“should probably not expect to raise venture capital for this venture” [Appendix B] rather than spend $100 million (in 1983 dollars) to develop a $3,995 device that weighed 2.5 lbs to be marketed to customers in the Chicago and Baltimore/Washington, D.C. service area. [11]

• Cell phones are used primarily to give the “ignorant masses” access to Facebook, Twitter, the Weather Channel, Google Maps and the music service Pandora (as well as apps, apps and more apps). In June 2004, Cingular announced that women are more likely to use a cell phone “to talk to friends and family” while men use theirs for business—including, evidently, the business of mating. [12]

• Convenience and safety—the two reasons people give for why they have (or “need”) cell phones—are legitimate reasons for using wireless technology; but they are not neutral. Convenience is the major justification for fast food, but its overzealous consumption has something to do with our national obesity “epidemic.” Safety spawned a bewildering range of anti-bacterial products and the overzealous prescription of antibiotics—which in turn led to disease-resistant bacteria. Our Cell Phones, Ourselves

After reading the above, you are flummoxed and realize that the average cell phone service at $63/month has a very, very low price elasticity because changes in price (upper or lower) have little influence on demand (PED). You realize AT&T knows as much as you do, and that they could increase your monthly bill by 1% or even a 5% without affecting the demand. Obviously the cell phone industry can’t be about profits. [You would have to increase the price of the phone and the service by 25% to affect the demand! [13]

Therefore, if it’s a choice between believing that magnetic dipole field reversal (triggered by massive and unprecedented electromagnetic pollution) is the goal, and not the unintended consequence of a business model based on demand for a device that gave everyone instant access to a news feed of the tooth-brushing habits of distant classmates they never never spoke with in high school, then I am forced to admit that a conspiracy between JP Morgan Chase, Motorola, the Telecom industry and The Global Financial Elite to make cell phones ubiquitous to change the earth’s magnetic field is a credible, viable theory.

Don’t know about you but we're getting back our landline, and henceforth will only use the cell phone for emergencies.

Click here to read why cell phones and the service is so cheap only the rich can afford a land line.

Katherine Smith, PhD, is a regular contributor to the home of Thought Provoking Articles.

"If you make people think they’re thinking, they’ll love you; but if you really make them think, they’ll hate you.” ~ Don Marquis

Endnotes

[1] Telegraphy began long before there were agreed electrical units, and the early lines were constructed and operated without measurements or rational design of any kind, especially in the United States. The old linesmen trekked across woods in a careful manner, turning aside from natural barricades. When maps of these first telegraphic lines are consulted, it is seen that these lines meandered with natural features common to the earth energy paths. As the telegraphic lines twisted and turned through the countryside and wilds in twisting vines of iron on tar-covered wooden poles, they directly intercepted ground energy.

Early telegraph lines intercepted earth energy with great regularity, often connected distant sacred spots together. We find all too numerous anecdotes and collections of reports in telegraphic trade journals, which indicate that an anomalous ground energy was entering the system components at certain critical seasons. These reports affirm that an earth "electricity" was energizing telegraph systems without the need for battery power at all.

Other reports tell of strange, automatic telegraph signals, which suddenly manifested during night hours. Still others report the peculiar ability of telegraph operators to "know who would call ... why they were calling ... and what the nature of the message would be". This phenomenon would be repeated in later years, when wireless operators began experiencing the very same things. The heightened consciousness experienced near these large grounded systems had everything to do with the reappearance of phenomena anciently observed along the meandering paths between sacred spots. The rediscovery of these anciently known truths was again making its appearance during the industrial revolution. http://mysite.du.edu/~jcalvert/tel/morse/morse.htm

[2] Replaced by the quantitative skills of geologists and engineers, we now scour across the land along quadrants and grids of our own design. No longer do planners observe the "urge" of the land. Few can afford the fees which truly gifted architects demand when demonstrating the geomantic skill. None will disagree however, that the geomantic skill does shape both mood and vision when properly executed in architecture. The released power exceeds the modern ability of measurement, evaluation, or quantification. The geomantic energy ... the earth energy ... defies quantitative analysis. It is an entity whose presence links both sensual experience, dream, vision, thought, imagination, and place. Numerous societies called this mysterious power by their own names. Chinese geomancers called this energy "Qi". Anglo-Saxon geomancers called it "Vril". Each is an ethnic name for the one earth energy. The organismic energy of earth, which manifests as a mysterious black radiance is seen throughout natural settings. It is observed beneath evergreen trees at noonday. "Earth Energy and Vocal Radio" Nathan Stubblefield

[3] The Global Financial Elite (TGFE, a variation of TPTB, a non-conspiracy term coined by G. William Domhoff, a Research Professor at the University of California) are the Rothschilds of Europe, Lazard Freres (Eugene Meyer), Kuhn Loeb Company, Warburg Company, Lehman Brothers, Goldman Sachs, the Rockefeller family, and the J.P. Morgan interests. These interests have merged and consolidated in recent years, so that the control is much more concentrated. National Bank of Commerce is now Morgan Guaranty Trust Company. Lehman Brothers has merged with Kuhn, Loeb Company, First National Bank has merged with the National City Bank, and in the other eleven Federal Reserve Districts, these same shareholders indirectly own or control shares in those banks, with the other shares owned by the leading families in those areas who own or control the principal industries in these regions. The "local" families set up regional councils, on orders from New York, of such groups as the Council on Foreign Relations, The Trilateral Commission, and other instruments of control devised by their masters. They finance and control political developments in their area, name candidates, and are seldom successfully opposed in their plans. Secrets of the Federal Reserve, The London Connection, Eustace Mullins

G. William Domhoff, a Research Professor at the University of California, Santa Cruz first coined the non-conspiracy acronym TPTB. He received his Ph.D. at the University of Miami and has been teaching at the University of California, Santa Cruz, since 1965. Four of his books are among the top 50 best sellers in sociology for the years 1950 to 1995: Who Rules America? (1967); The Higher Circles (1970); Who Rules America Now? (1983); and the non-"conspiracy" critique and theory of the U.S. power structure, The Powers That Be (TPTB) in 1979.

[4] February 21, 2009 Ellen Brown writes: “Funding the government’s budget shortfall has usually been left to private lenders; but those loans are drying up, and servicing them is proving expensive. Both this interest burden and the need to continually attract new lenders could be avoided by tapping into the government’s credit line at its own central bank.” Monetize This!: Resolving a Spiraling Public Debt Crisis

However, since October 2008, The Bank of the Fed is Closed…Forever.

The Federal Reserve are now making generous interest payments to the banks for “parking” their TARP (The Troubled Asset Relief Program) and other taxpayer bailout money instead of making loans to struggling Americans living in their cars and in tent cities. The Federal Reserve is paying banks NOT to make loans to struggling Americans!, Dennis Kucinich http://www.youtube.com/watch?v=Gkf8VG3HL_8

[5] Corporatocracy, in social theories that focus on conflicts and opposing interests within society, denotes a system of government that serves the interest of, and may be run by, corporations and involves ties between government and business. Where corporations, conglomerates, and/or government entities with private components control the direction and governance of a country, including carrying out economic planning notwithstanding the 'free market' label. http://en.wikipedia.org/wiki/Corporatocracy

Six Companies Own 96% of the World’s Media, National Vanguard Books, Who Rules America? Who Controls The U.S. Media? G. William Domhoff, a research professor at the University of California.

[6] Your cell phone has more computing power than NASA circa 1969

Today, your cell phone has more computer power than all of NASA back in 1969 when it sent two astronauts to the moon. Video games, which consume enormous amounts of computer power to simulate 3D situations, use more computer power than main frame computers of the previous decade. The Sony Playstation of today, which costs $300, has the power of a military supercomputer of 1997, which cost millions of dollars.

[7] U.S. telecommunications corporation was established as a subsidiary of Bell Telephone Co. (founded by Alexander Graham Bell in 1877) to build long-distance telephone lines and later became the parent company of the Bell System. The Bell System was the American Bell Telephone Company and then, subsequently, AT&T led system which provided telephone services to much of the United States and Canada from 1877 to 1984, at various times as a monopoly. In 1984, the company was broken up into separate companies, by a U.S. Justice Department mandate.

Monopoly, isn’t that suppose to lead to higher prices?

1984 "AT&T reduces long distance rates by 6.4 percent, as non-traffic sensitive costs begin moving from rates to local-company administered access charges. This was the first in a series of rate reductions over the next six years that totaled approximately forty percent." [AT&T: History: Milestones]

Federal Efforts to Control Monopoly

Critics believed that even these new anti-monopoly tools were not fully effective. In 1912, the United States Steel Corporation, which controlled more than half of all the steel production in the United States, was accused of being a monopoly. Legal action against the corporation dragged on until 1920 when, in a landmark decision, the Supreme Court ruled that U.S. Steel was not a monopoly because it did not engage in "unreasonable" restraint of trade. The court drew a careful distinction between bigness and monopoly, and suggested that corporate bigness is not necessarily bad.

The government has continued to pursue antitrust prosecutions since World War II. The Federal Trade Commission and the Antitrust Division of the Justice Department watch for potential monopolies or act to prevent mergers that threaten to reduce competition so severely that consumers could suffer. Concerns about the enormous power of the Standard Oil monopoly in the early 1900s, for instance, led to the breakup of Rockefeller's petroleum empire into numerous companies, including the companies that became the Exxon and Mobil petroleum companies. But in the late 1990s, when Exxon and Mobil announced that they planned to merge, there was hardly a whimper of public concern, although the government required some concessions before approving the combination. Gas prices were low, and other, powerful oil companies seemed strong enough to ensure competition.

[8] Wolves in Sheep's Clothing: Telecom Industry Front Groups and Astroturf

Wolves in Sheeps clothing, August 10, 2006, is an expose about the underhanded tactics used by telecom companies known as "Astroturf lobbying" -- creating front groups that try to mimic true grassroots to further corporate money, not citizen power.

According to the article and Common Cause’s vice president for communications Mary Boyle, these sorts of campaigns are dangerous for our democracy. Corporations that already have significant economic clout and influence are trying to co-opt the voices of everyday citizens and think tanks, and use them to their own advantage and support the industry's agenda… the bottom line.

Common Cause believes that when Congress wrote the 1996 Telecommunications Act, the law that gave us less competition, higher prices and more concentrated media.

I contacted Mary and pointed that since 1999 the price of wireless phone services declined each year. She got angry and hung up the phone.

Common Cause 1133 19th Street NW, 9th Floor Washington, DC 20036 202.833.1200 800.926.1064

Mary Boyle 202-736-5770, 202-487-0518 cell, mboyle@commoncause.org

[9] In 1946 (October) - first "car phone" - Motorola communications equipment carried the first calls on Illinois Bell Telephone Company's new car radiotelephone service in Chicago, Illinois, USA. On April 3, 1973 Martin Cooper won the race when he placed the first cell phone call to his rival at AT&T. In 1977 cell phones went public. Chicago was the first city to trial cell phones with 2000 customers. In 1983 Motorola, with the help of Martin Cooper, introduced the 16-ounce "DynaTAC" the first truly portable cellular phone. This phone took 15 years and a cost of over 100 million dollars to come to market. The cost to the consumer was $3,995. It weighed 2.5 lbs., took 10 hours to charge and allowed 35 minutes of talk time. Features were limited to dial, listen and talk.

[10] Ted Butler, noted silver analyst has already found JP Morgan Chase guilty of Downward manipulation (DM). DM Downward-manipulation is an uneconomic aberration discovered in the precious metals market. We are conditioned to believe that prices are always inflated so the greedy corporations can make more money but Ted Butler’s research confirmed the price of silver had been manipulated to stay at the $4-5 price range for years. The beneficiaries of this type of manipulation are the consumers since industrial users can sell their products cheaply and still make a profit. (The Real Story, Theodore Butler, Silver But No Silver Lining, The Myth of the "Free" Enterprise Economic System)

Behind every consumer society is the reality of a credit-based monetary system and a fiat currency. Behind every fiat currency is a Federal Reserve or a Central Bank controlled by The Global Financial Elite (TGFE). TGFE include, Rockefeller, Kuhn, Loeb and J.P. Morgan, Ted Butler’s prime suspect in the “ongoing intentional not accidental” great crime of keeping the prices low so just about everyone can have that glamorous, smart or dumb phone of their dreams, an electromagnetic nightmare for the planet.”

Downward manipulation is an uneconomic aberration first discovered in the precious metals market by the noted silver analyst, Ted Butler. We are conditioned to believe free enterprise supply and demand would lead to inflated prices so the greedy corporations can make more money, but Ted Butler’s research in the silver market concludes the opposite.

The beneficiaries of this type of manipulation are the consumers because corporations can sell their products affordably and still make a profit. The Myth of "Free" Enterprise Economic System

Butler’s investigation has identified JP Morgan Chase, one of the founding members of the Federal Reserve, as the prime suspect, in the “ongoing intentional, not accidental” great crime of keeping the price of commodities low so the middle class can afford the cell phone American dream, an electromagnetic nightmare for the planet. The Real Story, By: Theodore Butler

[11] I’ll get right to the point. Venture Capitalists wouldn’t survive long enough to be called vulture capitalists if they made a 100 million dollar investment in a business model that when evaluated by The Finance Authority of Maine and Masthead Venture Partners concluded Motorola should “should probably not expect to raise venture capital for this venture”

See Appendix B Financing Bright Ideas, A Primer On Venture Capital In Maine to understand why the cell phone industry never made “cents.”

[Excerpt from Federal Over Nightmare Express]

June 18, 1971 - Smith founded Federal Express with his $4 million inheritance (about $21 million in 2008 dollars), and another $91 million (about $484 million in 2008 dollars) in venture capital. Fred Smith on the Birth of FedEx

Whoa, Venture what?

Venture Capitalists wouldn’t survive long enough to be called vulture capitalists if they went around making a $484 million investment in a business model that received a mediocre grade from a Yale Economics professor.

Even a child without a degree from Yale knows that for Fred to be successful, a massive investment in infrastructure would be required. An investment made in anticipation of a mass market for an overnight service, in which the pricing would have to be downward manipulated low enough…to create demand. The Myth of "Free" Enterprise Economic System

Fred didn’t bother with any market research to justify the investment because in 1973 there weren’t millions of Americans saying to them selves, “Damn, I forgot it was Grandma’s birthday tomorrow. Why the heck isn’t there an affordable overnight service to get Granny’s birthday card delivered, before 10 a.m.?”

Or better yet, you are the ex-Tennis Pro, Michael Zausner. Michael invented Solar Recover, a natural spray to rehydrate skin when people spend too much time in the sun. Michael wants to start a business that will employ three full-time and 10 part-time employees, but his customers won’t order Solar Recover unless they can get that hydrating spray delivered overnight…for $9.95.

The overnight delivery market exists because of a downward manipulated price (cost-effective) created the demand. Silver, but no Silver Lining

You don’t send that overnight letter because it’s $9.95; it’s $9.95 to get you to send it to Granny. [End of excerpt]

[12] “Despite the almost unlimited nature of what you can do on the web, 40 percent of U.S. online time is spent on just three activities – social networking, playing games and emailing leaving a whole lot of other sectors fighting for a declining share of the online pie,” said Nielsen analyst Dave Martin. What Americans Do Online: Social Media And Games Dominate Activity

[13] Even a child without a degree from an Austrian School of Economics knows the Cell phone industry can’t be about profits unless you believe AT&T doesn’t know about The Price Elasticity of Demand (PED). Economists use PED to measure the rate of response of quantity demanded due to a price change. A very high price elasticity suggests that when the price of a good goes up, consumers will buy a great deal less of it and when the price of that good goes down, consumers will buy a great deal more.

The handset/phone subsidy, an initial loss

Most people, however, do not want to pay hundreds of dollars for what they consider to be an average phone. So, to help customers, wireless companies will discount their phones when you sign up for a new plan. What this means for you is that the wireless carrier actually may have paid $250 for a phone that they then sell to you for $100. That difference of $150 is called the handset/phone subsidy, and actually represents an initial loss.

Does anyone really think the cellphoneaddict would give up his smart or dumb phone if it was only subsidized by $105 instead of $100? Multiply $5 x millions of phones sold per year and you get the profit the greedy cell phone manufacturers gave up because they didn’t hire me to do a price elasticity study. http://www.prepaid-wireless-guide.com/subsidies.html

Is this free Enterprise?

Don’t bother trying to argue the price is based on the reduced competition [already admitted to by the Justice department] because that would imply we have a "Free" Enterprise Economic System, an economy governed by the laws of supply and demand, not restrained by government interference, regulation or subsidy; because then you would have to admit that you and Arianna Huffington don’t believe that Wall Street Shafted Main Street and that corporate greed and political corruption are undermining America, Pigs at the Trough, BTW a Free Enterprise system wouldn’t be filing antitrust lawsuits to prevent the merger between AT&T and T-mobile.

Ours economic system is a Command economy, basically a slave enterprise where supply and price are regulated [downward, not upward as you would expect] by the government [really the Federal Reserve] rather than market forces.

The only thing I will agree with about the “law of supply and demand” is that supply at a downward-manipulated price, can create demand.

Capitalism Never Made “Cents”

The ideal and the principle of the market economy of Capitalism was never fulfilled.

What is called capitalism is a distorted, twisted and deformed system of increasingly limited market relationships as well as market processes hampered and repressed by state controls and regulations. And overlaying this entire system are the ideologies of 18th-century mercantilism, 19th-century socialism, and 20th-century welfare statism.

Professor Ebeling, the Ludwig von Mises professor of Economics at Hillsdale College, understood something was wrong when he wrote: “the perverse development and evolution of historical capitalism, the institutions necessary for a truly free-market economy have been either undermined or prevented from emerging.”

But when he claimed, “it is the principles and the meaning of a free-market economy that must be rediscovered” in order to overcome the burden of historical capitalism and save liberty, He should have written principles must be rediscovered in order overcome the burden, according to the GEO4, the pressures on the land and the extinction of species due to “the dangers of climate change, water scarcity and dwindling.” It didn’t matter if we listened to Keynes, Friedman or Mises; or for that matter anyone from the Rothschild-funded Austrian School of Economics, consumerism never made economic, environmental, or common sense.

Appendix A

Earth Batteries http://www.icehouse.net/john1/stubblefield.html

Those who are familiar with the lure of scientific archives understand very well that more potential technology lies dormant than is currently addressed, discussed, or implemented. Much of modern scientific research is the weak echo of work already completed within the last century. The notion of drawing up electrical power from the ground sounds incredibly fanciful to conventional scientists, but numerous patents support the claim. A number of retrieved patents list compact batteries, which can operate small appliances by drawing up ground electricity. Others describe methods whereby enough usable electrical power may be drawn out of the ground itself for industrial use. The existence of these devices is concrete, documented in several unsuspected and unstudied patents.

"Earth batteries" have been detailed in a previous article. Their history can be traced back to experiments performed by Luigi Galvani on copper plates in deep stone water wells. Currents derived through these gave Galvani and his assistants "shivering thrills and joyous shocks". Thereafter, a certain Mr. Kemp in Edinburgh (1828) worked with earth batteries, so that we know these designs were already being seriously studied. They demonstrate the validity of very anciently held beliefs concerning the generative vitality of earth itself.

Several of these devices were employed to power telegraphic systems (Bain), clocks (Drawbaugh), doorbells (Snow), and telephones (Meucci, Strong, Brown, Tompkins, Lockwood). Earth batteries are an unusual lost scientific entry having immense significance. Developed extensively during Victorian times, the earth batteries evidenced a unique and forgotten phenomena by which it was possible to actually "draw out" electricity from the ground. The most notable earth battery patent, however, is one, which operated arc lamps by drawing "a constant electromotive force of commercial value" directly from the ground. In addition to this remarkable claim, a vocal radio broadcast system ... through the ground.

Geomancy http://www.lauralee.com/antenna2.htm

In truth, the art of wired and wireless communication began in a reawakened appreciation of geomancy and geomantic energies. This remarkable reminder came about with the replacement of the original 2-wire telegraph line (Reusser, 1794) by the 1-wire method (Aldini, 1803), the latter requiring far less wire and several ground plate terminations. The telegraph stations of Morse used grounded plates, a means by which engineers imagined the "necessary return current...through the ground". Wired code on a single overhead wire was thus "matched" by an opposed ground return of charge, a condition which fulfilled the prevalent model of electrical closure.

The metaphysical earth currents were both observed and described in great detail by Fr. Athanasius Kircher. His writings preserve an ancient knowledge which concerned itself wholly with the vitality of the earth. The metaphysical telluric currents were known to permeate the world, the energies which mediating vitality. Maps of telluric currents were the prized possessions of geomancers, permitting the knowledge of vitality control on earth. It is said that wars were fought by the selective elimination or exaltation of specific veinworks in the telluric circulatory system. The science of Geomancy thus formed the mysterious historical backdrop against which a wide variety of natural observations were subsequently made.

With time, the experiential appreciation for the metaphysical earth energies was systematically lost. The more qualified scientific observers replaced their sensitive experience of telluric energies with a merely superficial observation of geoelectric currents. This schism has provoked the controversial thesis upon which our present discussion is therefore based. While some will be defiantly confident that experiential telluric energies are resolved into geoelectrical currents, we remain just as adamant in our absolute conviction that the experiential telluric energies precede and define the observed geoelectric patterns. This schism has not, and will never be resolved. So long as there are those who insist on observing the superficialities of natural phenomenon, completely obsessed with the kinematics of otherwise experience-filled phenomena, there will be a scientific conflict.

When the subject of long-distance communications was compelled to shift thematic emphasis away from the vitalistic foundations, it lost touch with an energy which did not cease exerting strong influences on the developing electrical technology of the time period. Only a few, now legendary researchers, continued the geomantic tradition. From the very first moment in which ground connections were established in a telegraphic signalling line, inventors and operators of electrical systems noticed anomalous energetic behaviors in the ground. The very first attempts at long distance telegraphy involved the burial of highly insulated double lines (Morse and Vail). Upon first closure of the telegraph key, the signalling components became so thoroughly suffused with charge that the exchange of signals became an impossibility.

Appendix B

[From Financing Bright Ideas A Primer On Venture Capital

In Maine, Cell Phone Business Development answers below are in Bold]

Venture capital n. Money for investment in innovative enterprises or research in which both the risk of loss and the potential for profit may be considerable.

The American Heritage® Dictionary of the English Language, Fourth Edition

Capital is the lifeblood of businesses. While no amount of money will make a bad business successful, no business can survive without enough money to develop products, hire employees, establish markets and attract customers.

For many businesses, particularly in the early stages before profits become predictable, traditional sources of capital such as banks and credit unions are simply unavailable. For those businesses, venture capital may be the best hope to raise the money needed to succeed.

Are You Ready For Venture Capital? A Self-Assessment

There is no magic formula for determining when or whether a business is going to get funding from venture capital investors. However, the following table will give you an idea of whether you might be well received by investors and where you need to focus your attention on improving your Business Plan. Simply give your business an honest assessment on each of the questions and circle the highest applicable score in the column on the right. When you are done, add your scores. The key at the end of the assessment will give you an idea of how prepared you are for venture capital.

PRODUCT OR SERVICE

1. How badly does your customer need this product or service?

A “must-have” that solves an important problem 3

A compelling and unique product or service 2

The product or service is an improvement over the competition 1

Customers might want it but do not necessarily need it 0

I don’t know whether there are customers for it -2

2. Is there any protection from competitors?

Patent protection is in hand or in process 2

Copyright protection or hard-to-discover trade secret 1

By the time competitors wake up, I’ll have the top name in the market 0

No barriers to competition, or the product is already available in the market -2

STAGE OF DEVELOPMENT

3. At what stage is your product development?

The product is available and has been proven in the marketplace 2

There is a working prototype and it is ready for production 1

The product is developed but needs more work before it can be sold 0

We will develop the product as soon as we get venture capital -2

4. How much progress have you made in developing key customers?

We have strong customers who are advocates for our products 2

We have identified key customers and are making good sales progress 1

We need to further develop the product before generating sales 0

5. Is your venture a business or a project?

The business is operating, has growing revenues and happy customers 2

Everything is in place to launch the business as soon as we get funded 1

I need funding to finish product development and testing 0

MARKET SIZE AND SHARE

6. How big is the potential market for your product?

More than $500,000,000 2

$75,000,000 to $500,000,000 1

Less than $75,000,000 0

[DynaTAC's retail price, $3,995 ($8807 in present-day terms, ensured that it would not become a mass-market item]

7. How fast is the market growing?

Greater than 20% per year 2

10% to 20% per year 1

Less than 10% 0

8. How big a share of the market can you realistically get in 5 years?

Greater than 15% 2

5% to 15% 1

Less than 5% 0

MANAGEMENT

9. How experienced is the Chief Executive Officer?

Has run similar companies that have had successful exits for investors 4

Has built and run a similar company successfully 3

Has extensive experience in the industry and is well known 2

Knows the product well 1

A CEO will be recruited 0

I can learn on the job -2

10. Is the founder ready to relinquish control if necessary to make the business achieve its full potential?

Yes, the business needs to be run by the best possible management team 2

Theoretically yes, but I do not plan to let that happen 0

No, this is my business and I know best how to make it successful -2

READINESS TO PURSUE VENTURE CAPITAL

11. Do you have a business plan?

Yes, it is well researched, very complete, and customers are anxious 2

Yes, although I am still filling in some details 1

Only a rough outline, but the product is great 0

This idea is so good it doesn’t need a business plan -3

12. Are you willing to allow investors to be involved in business decisions?

Yes, they will serve on the Board and play an influential role 2

I will put them on an Advisory Board 1

No, I really don’t think they can help me right now 0

13. What percentage of the ownership in your company are you willing to give up?

I will give up one-third or more for the right investors 2

I would rather not give up more than a quarter of my company 1

I will give up a small amount of ownership if I have to 0

RETURN POTENTIAL

14. What return on investment can your investors expect?

Ten times their investment or more 3

Six to nine times their investment 2

Four to five times their investment 1

Less than four times their investment 0

15. How long do you realistically think it will be before the investors can receive their return on investment?

Five years or less 2

Five to seven years 1

More than seven years 0

16. How do you realistically expect the investors to get their return on investment?

We will be an attractive IPO candidate or candidate for sale to the leaders in our industry 2

We will be acquired by a similar company in our industry 1

We will pay dividends and the company or I will buy their stock back

OTHER

17. I plan to use the money raised to:

Further develop the business 0

Pay my living expenses -2

Pay off debt or other investors -3

18. When this money is spent, I will:

Be profitable and growing rapidly 2

Be at cash flow breakeven and growing, with profits in sight 1

Be at cash flow breakeven 0

Need to raise more money to keep going -3

Grand Total: 9

Point total 30 to 38: You have an interesting proposal that should garner the interest of venture investors.

Point total 23 to 29: Your business has possibilities and might be of interest to angel investors, but probably needs more work before you will be able to raise significant venture capital.

Point total 16 to 22: You may be on to something here, but you probably have a way to go to attract investors.

Point total 10 to 15: A long shot. Reread this Primer and go back to the drawing board.

Point total below 10: You should probably not expect to raise venture capital for this venture

Appendix C

Hemant K. Sabat, author of The Network Investment Economics of the Mobile Wireless Industry serves as the Chairman, President and Chief Executive Officer of Coscend Communications Solutions. I contacted Mr. Sabat and offered to engage him as a consultant to confirm or refute my belief that the Telecommunications industry was never a rational or viable business model based on the risk due to the massive investment required for the infrastructure to provide adequate service and coverage.

He was unable to consult with me privately and referred me to a number of companies, institutions and research firms that he thought would be able to handle my request.

Indian Institute of Management Bangalore,

University of New South Wales Haresh Luthria, Fethi. Rabhi

Giri K. Tayi, Ram Ramanathan, S. S. Ravi and Sanjay Goel

Nan Hu

School of Information Systems, Singapore Management University, 178902 Singapore. E-mails: {hunan, cyma, yjli}@smu.edu.sg

School of Business, State University of New York at Albany, Giri K. Tayi

College of Business Texas Tech University, Dr. Rajiv D. Banker, Merves Chair in Accounting and Information Technology

Virginia Polytechnic Institute and State University (Virginia Tech)

Harbinger Capital Partners, Gartner, Inc., Forrester

I sent them the following email:

Mr. Sabat (currently the CEO of Coscend) suggested I contact you about the research I am doing on the telecommunications industry. I am prepared to engage you on a consulting basis.

I need someone with your expertise and background to either confirm or refute my premise that the Telecommunications industry was never a viable rational business model.

I believe the capital came from Goldman Sachs and Morgan Stanley (basically the Federal Reserve).

The business model could only be successful if the investors anticipated a demand based on a downwardly manipulated price for the products and services. I am a published author and have written about this aberration numerous times at The Market Oracle and other popular websites.

12 Dec 2008 - Silver, But No Silver Lining

20 Dec 2008 - The Future of Silver- TELEPATHIC interview with Adam Smith

05 Nov 2009 - The Great U.S. Housing Market Foreclosure Robbery Of The 21st Century

29 Oct 2009 - The Myth of "Free" Enterprise Economic System

As you know the industry struggled until the last few years and the wireless guide article below points out the illogical pricing of the industry.

Cell Phone Plans Get Cheaper:[From http://wirelessguide.org/

The price of wireless phone services declined each year from '99 to '08, despite reduced competition as the $150 billion industry consolidated, a U.S. report said on Thursday. The Government Accountability Office, the audit arm of the U.S. Congress, said consolidation has led to domination of the sector by AT&T Inc, Verizon Wireless, Sprint Nextel Corp and T-Mobile USA Inc. The GAO study found that wireless Industry consolidation has made it more difficult for small and regional carriers to be competitive. However, consolidation may have helped the biggest carriers become more efficient, allowing them to offer more services for similar or lower prices while improving coverage, it said.

Major findings are include:

-

- Just four companies -- AT&T, Sprint Nextel, Verizon and T-Mobile -- control 90% of the U.S. wireless market. Cellphone plan prices have dropped 50% since 1999. Coverage is better too.

- There are about 285 million U.S. wireless subscribers. Nearly 40% of households rely primarily on wireless devices. The cellphone industry generates more than $150 billion in annual revenue.

- There are at least 60 mobile virtual network operators in the U.S. These are companies such as TracFone, which do not own any cellphone towers. Instead, they buy bandwidth wholesale from a bigger company, such as AT&T, repackage it, and sell it to consumers.

The GAO report urges the FCC to collect better data on special access rates and other issues. [End of Excerpt]

Let me know how we can proceed. I am looking forward to working with you.

Robert Singer, skype rds2301@yahoo.com, cell phone 818 571-**** [End of Email]

No one accepted my offer of a consulting assignment. Linking the Federal Reserve to, and questioning the funding of the Telecommunications industry would be a problem for industry leaders.

Appendix D

When the American economy headed into a recession at the end of the dot-com bubble, the Federal Reserve began slashing short-term interest rates until they reached a historically low one percent. The move re-inflated the economy by allowing homeowners to extract $750 billion in equity from their homes—up from $106 billion in 1996—and apply the dollars toward a multitude of consumer items and other credit card debt.

As interest rates plummeted and alleged home equity artificially soared, buyers were able to afford first and second homes, and they did it by taking out risky mortgages with “teaser rates” similar to those offered by the credit card industry. Even as interest rates adjusted upward, the sponsoring banks used complicated financial derivatives to resell the risky mortgages as “asset-backed paper.”

As housing prices edged downward and mortgage rates inched upward, the recession was put on hold with the help of an astonishing 10 to 12 credit card offers per month being delivered to some consumer mailboxes. The credit card companies issued 1.5 billion cards to 158 million cardholders and promised an improbable zero percent interest—some deals for up to 18 months. (Similar to mortgage debt, the credit card debt is put into pools, also known as derivatives, that are then resold to investment houses, other banks and institutional investors.)

Direct and Indirect Money Creation

Not only is virtually the entire money supply created directly by the Fed, but a mere handful of very big banks indirectly create hundreds of trillions of dollars using a massive innovative “risky” investment scheme known as “derivatives.” Click here to read The Economics of Derivatives

According to the Comptroller of the Currency, the books of U.S. banks now carry over $180 trillion in the form of derivatives.

The derivatives represent the money created world-wide since 1910—out of thin air. About 40 percent of the $10.5 trillion U.S. national debt is owed to the Fed. But the loss to TPTB, if the U.S. defaults on that debt, won’t be $4.2 trillion or even $180 trillion, but about $500 trillion--money created out of thin air over the past 100 years to pay for our consumer society.

To make absolutely sure we don’t ask any questions about where this massive amount of monopoly money is coming from and who benefited, the banking system has been contrived so that these big banks always [appear] to get bailed out by the taxpayers when in actual fact TPTB directly and indirectly is picking up the tab.

The Federal Reserve is guilty of manipulating the short-term interest rates and the money supply until October 2008, but the beneficiary of this almost unlimited liquidity crime was the American consumer. Was the 2008 Financial Collapse An Inside Job?

Essays on how TGFE are losing billions.

The Myth of "Free" Enterprise Economic System

12 Dec 2008 - Silver, But No Silver Lining

20 Dec 2008 - The Future of Silver- TELEPATHIC interview with Adam Smith

19 Nov 2009 - Show Me the Money

05 Nov 2009 - The Great U.S. Housing Market Foreclosure Robbery Of The 21st Century

20 Nov 2009 - Farms, Hamburgers, and “Free” Enterprise

http://www.thepeoplesvoice.org/TPV3/Voices.php/2011/11/24/cellphonemania-why-is-the-u-s-justice-de