JPMorgan To Fire Thousands

FT

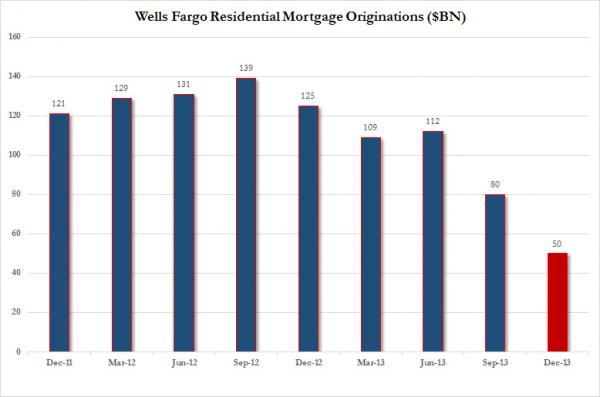

Following last year’s realization that mortgage origination as a product line is effectively dead (which has forced such origination dependent banks as Wells Fargo to return to subprime lending in hopes of keeping the revenue stream alive, knowing full well how it all ends), and that only investors and “all cash” buyers are keeping the myth of the housing recovery alive on their shoulders, banks fired tens of thousands of workers in the mortgage business hoping to stem the bottom line bleeding from the collapse in revenues. It turns out that they didn’t fire enough and/or that the housing market contraction was far worse than even the banks, in their most, pessimistic forecasts, had expected. Case in point: JPMorgan, which after firing 15,000 in its mortgage business, has just revealed it will fire thousands more.

Several thousand more cuts are planned, according to people familiar with the matter, and could be announced at JPMorgan’s annual investor day on Tuesday. They are part of a new efficiency drive at the largest US bank by assets that also encompasses staffing branches with fewer employees.

Profitability at JPMorgan remains stronger than at competitors such as Bank of America and Citigroup but the bank is looking to find new savings, partly because of technology that allows greater automation of clerical functions in branches and partly because of a plunge in demand for mortgage refinancings.

Rising interest rates have stifled demand, causing the biggest banks to cut tens of thousands of positions over the past two years. The additional cuts at JPMorgan are expected to number more than 2,000, evidence of the steep decline in demand even in the past 12 months.

The bank, which employs more than 250,000 people, is also looking to cut thousands of jobs in branches over time, though it expects to do so by attrition.

JPMorgan executives decided in the past 12 months to halt its branch-building programme, following a trend for banks to look online for future growth rather than to bricks and mortar.

We doubt many tears will be shed over the terminations, especially since JPM was the one bank holding out longer than most in hopes that things will finally change for the better and the bank’s “fortress” balance sheet will be able to isolate the firm’s workers. They didn’t, and it didn’t.

JPMorgan held out longer than rivals, filling in gaps in the market in Florida and California, in particular, before now joining the long list of banks to have scaled back their growth plans.

“It was awfully 20th century of them,” said Mike Mayo, analyst at CLSA Securities. “With such weak revenue growth – the worst in eight decades – banks need to find new ways to control expenses, which means finding other ways to streamline branches and other distribution. The last two years have seen the most branch closings in history.”

Yet while JPMorgan’s terminations – merely a stepping stone to even more layoffs in the future – mean the unemployment rate will continue to drop as most of the newly laid off will simply drop out of the labor force entirely, the biggest loser will be Wells Fargo, whose primary revenue line was and is mortgage origination. Well, was.

We look forward to seeing just how the California bank, and largest mortgage originator in the US, will offset what is now clearly a secular collapse in mortgage demand as more and more Americans simply refuse to (or can’t) take out mortgages to buy homes whose prices have become inaccessible to all but a very select (0.1%) few.