Key Events In The Coming Week: All Eyes On Jackson Hole

Tyler Durdan

With earnings season now over, looking at the week ahead the highlight will be the Jackson Hole gathering on Thursday and Friday, where central bankers will be meeting (virtually this year) for the annual economic symposium. This theme this year is “Navigating the Decade Ahead: Implications for Monetary Policy”, and one of the key highlights will be Fed Chair Powell’s speech on Thursday on the topic of the monetary policy review. As DB's Henry Allen writes, the bank's US economists note that while it's possible that the policy review results will be released along with Powell’s appearance, they think it’s more likely that he summarizes the key findings and outlines the likely implications for the Fed moving forward. They think instead the review results won’t be released until the next meeting in mid-September. In addition to Powell, central bank watchers will have plenty of other speakers to look out for at the gathering, including Bank of England Governor Bailey, ECB chief economist Lane, and Bank of Canada Governor Macklem.

Turning to politics, attention will also be on the Republican National Convention taking place this week from Monday to Thursday, even if there aren’t likely to be as many market-moving headlines compared to Jackson Hole. Nevertheless, a CNN report said that President Trump would be appearing on every night of the convention, according to a Republican familiar with the convention planning, on top of his own speech planned for the Thursday night. So that could generate some news depending on the nature of any remarks. There are just over 10 weeks to go now until election day on November 3rd, and according to the polling averages, President Trump continues to lag behind Biden.

On the data side, we don’t have many top-tier releases with the US jobs report not until the following week. However, tomorrow will see both the Ifo’s business climate indicator from Germany, as well as the Conference Board’s consumer confidence from the US. The recent breakdown in fiscal negotiations in Congress could weigh on consumer attitudes, and DB economists see the number falling to 92.0 (vs. 92.6 in July).

Courtesy of Deutsche Bank, here is a day-by-day calendar of events:

Monday

Tuesday

Wednesday

Thursday

Friday

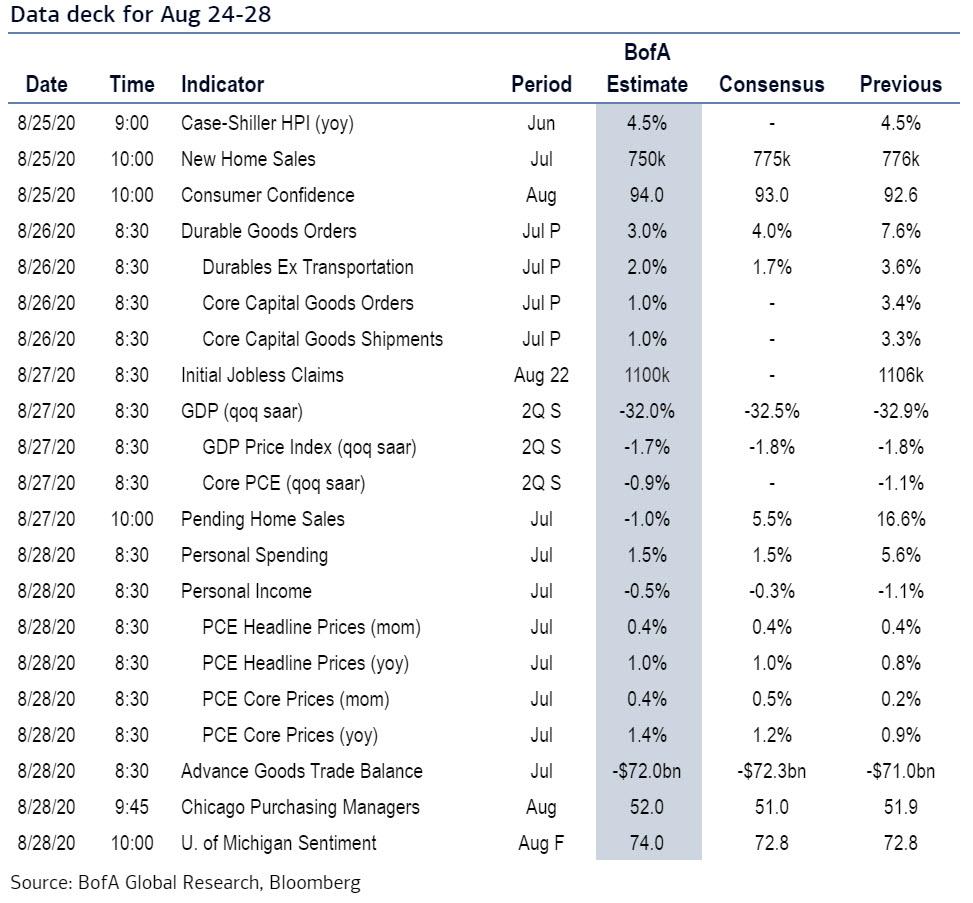

Finally, here is Goldman's take on the key events in the US, where the key event this week is Fed Chair Jerome Powell's speech at the Jackson Hole Economic Symposium. The key economic data releases this week are the durable goods report on Wednesday, the second Q2 GDP estimate on Thursday, and the personal income report on Friday.

Monday, August 24

Tuesday, August 25

Wednesday, August 26

Thursday, August 27

Friday, August 28

Source: Deustche Bank, Goldman, BofA

https://www.zerohedge.com/markets/key-events-coming-week-all-eyes-jackson-hole