UNDERSTADING THE WHOLE 'GAMESTOP' DEBACLE ON WALL STREET THIS WEEK

Hal Truner

There is gigantic tumult taking place this week on Wall Street, with the entire Stock and Bond market talking about Gamestop.

Here's an explanation of what went on:

There is gigantic tumult taking place this week on Wall Street, with the entire Stock and Bond market talking about Gamestop.

Here's an explanation of what went on

So some bigshots in Hedge Funds on Wall Street got beaten at their own game, and now they're all screaming that the general public should not be allowed to do what Wall Street itself has been doing for decades!

Put simply, for the filthy rich, it's somehow OK for THEM to manipulate pricing to grab other people's money, but when the general public gets together to do the exact same thing (and thereby wipe out the filthy rich) it should somehow be illegal.

A bunch of Day-Traders who talk amongst each other on a chat server named "WallStreetBets" hosted by DISCORD, realized they could act together and drive the value of a stock up to their own benefit because a Hedge Fund publicly reported they had a position in that stock (Gamestop). So the Day Traders began buying Gamestop stocks and the price went up.

Firs thing that happened was the rich guys, who saw themselves starting to lose Billions to these Day Traders, had the chat hosting server SHUT OFF to prevent people from talking about it!

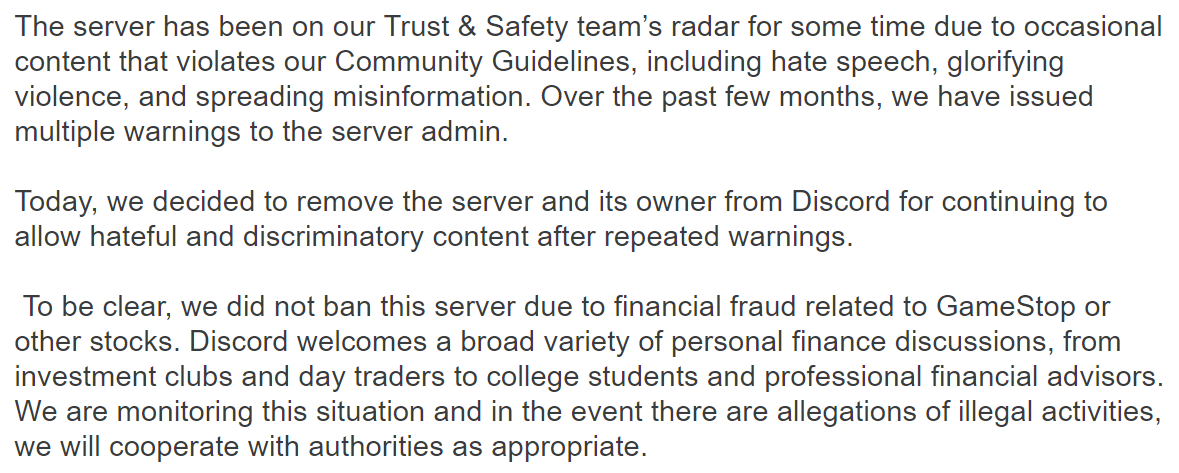

The chat server, a company named DISCORD, shut down the chat server then apparently lied about why they did it. Here's the DISCORD explanation:

Oh, so group buying of stocks is now "Hate Speech?" "Racism?" Even the Wall Street Journal called it "Straight up White Supremacy." (HT Remark: WOW, these filthy rich guys pull out all the stops when trying to justify their manipulation of the markets! ! ! ! )

Making matters worse is what Stock Brokerage Houses did during this fiasco: They took it upon THEMSELVES to prevent their customers from buying more stick in Gamestop! This meant that the general public was being prevented from buying more of the stocks, and thereby putting more of a hurt on certain of their Hedge Fund buddies! That's price-fixing and it is a violation of the Sherman Anti-Trust Act . . . but the Brokerage Houses did it anyway.

Then, in an even more spectacular act, at least one Brokerage House, Robinhood, decided it would begin SELLING the stocks held by their customers, **** WHETHER THE CUSTOMER WANTED TO SELL OR NOT ****

This had the effect of driving DOWN the price of the stock, thus saving the Hedge Fund and screwing their customers out of profits.

The Stock Market showed itself to be completely "rigged" this week, with the ultra rich who own Stock Brokerages, showing they are perfectly willing to engage in outright price-Fixing and actually STEAL their own customer's stocks (by selling them without authorization) so as to protect their rich buddies.

If people leave their money in Stock Brokerages after this brazen display of criminality, they're fools. People should start pulling ALL their money out of stock brokerages that committed these acts and drive those brokerages out of business immediately.

(Securities Laws require me to tell you that "I am NOT a licensed financial planner and cannot give financial advice. Consult a licensed professional -- the same type that did the price-fixing and stealing -- before making any financial decisions.)

So some bigshots in Hedge Funds on Wall Street got beaten at their own game, and now they're all screaming that the general public should not be allowed to do what Wall Street itself has been doing for decades!

Put simply, for the filthy rich, it's somehow OK for THEM to manipulate pricing to grab other people's money, but when the general public gets together to do the exact same thing (and thereby wipe out the filthy rich) it should somehow be illegal.

A bunch of Day-Traders who talk amongst each other on a chat server named "WallStreetBets" hosted by DISCORD, realized they could act together and drive the value of a stock up to their own benefit because a Hedge Fund publicly reported they had a position in that stock (Gamestop). So the Day Traders began buying Gamestop stocks and the price went up.

Firs thing that happened was the rich guys, who saw themselves starting to lose Billions to these Day Traders, had the chat hosting server SHUT OFF to prevent people from talking about it!

The chat server, a company named DISCORD, shut down the chat server then apparently lied about why they did it. Here's the DISCORD explanation:

Oh, so group buying of stocks is now "Hate Speech?" "Racism?" Even the Wall Street Journal called it "Straight up White Supremacy." (HT Remark: WOW, these filthy rich guys pull out all the stops when trying to justify their manipulation of the markets! ! ! ! )

Making matters worse is what Stock Brokerage Houses did during this fiasco: They took it upon THEMSELVES to prevent their customers from buying more stick in Gamestop! This meant that the general public was being prevented from buying more of the stocks, and thereby putting more of a hurt on certain of their Hedge Fund buddies! That's price-fixing and it is a violation of the Sherman Anti-Trust Act . . . but the Brokerage Houses did it anyway.

Then, in an even more spectacular act, at least one Brokerage House, Robinhood, decided it would begin SELLING the stocks held by their customers, **** WHETHER THE CUSTOMER WANTED TO SELL OR NOT ****

This had the effect of driving DOWN the price of the stock, thus saving the Hedge Fund and screwing their customers out of profits.

The Stock Market showed itself to be completely "rigged" this week, with the ultra rich who own Stock Brokerages, showing they are perfectly willing to engage in outright price-Fixing and actually STEAL their own customer's stocks (by selling them without authorization) so as to protect their rich buddies.

If people leave their money in Stock Brokerages after this brazen display of criminality, they're fools. People should start pulling ALL their money out of stock brokerages that committed these acts and drive those brokerages out of business immediately.

(Securities Laws require me to tell you that "I am NOT a licensed financial planner and cannot give financial advice. Consult a licensed professional -- the same type that did the price-fixing and stealing -- before making any financial decisions.)

https://halturnerradioshow.com/index.php/en/news-page/news-nation/understanding-the-whole-gamestop-debacle-on-wall-street-this-week